There's not much point in applying all the wonderful tips you learn reading PF blogs if you end up a millionaire but die at 50!. Aside from the obvious health tips - don't smoke, drink in moderation, drive carefully, avoid high-risk activities (unsafe sex, drug use, freestyle rock climbing, cave scuba diving etc.) the most important keys to living long (and healthy) enough to enjoy your wealth are getting enough exercise and maintaining a healthy body weight/BMI.

Personally I'm overweight and need to modify my diet to a more healthy one so I can get down to my ideal BMI in a healthy way (no crash dieting!) and then maintain it for the rest of my life. I've read up a bit on CRAN (calorie restriction with adequate nutrition) which basically means reducing the amount of calories you eat while watching out that you are still getting the optimal amounts of vitamins, protein, fat (yes, some IS needed) and carbohydrates. Up to now CRAN has been mostly theoretical, based on observations and experiments with short life-span animals. This research showed that when a test animal's diet was restricted to about 25%-40% less calories than would be eaten in a totally "unrestricted" diet, the average life-span was extended (up to 50%) and a more healthy old age resulted (although there's not much evidence that it increases the maximum possible life-span).

It now appears that longer-term experiments with longer-lived species that are more similar to ourselves are providing more evidence that CRAN is likely to be beneficial to humans wanting to live longer and healthier life-spans. See this article for a very interesting update that shows the very positive effects of CRAN on monkeys.

Personally, applying CRAN means reducing my average daily calorie intake from around 3,200 kcals down to a healthy 2,000 kcals by eliminating junk foods - I tend to snack on icecreams, sweets, chocolate, biscuits etc. which are all totally unnecessary (and expensive!). I'm hoping to reduce my BMI from 31.5 (100 kg) down to 22.1 (70 kg) by the middle of next year. I think I'll add this goal as another bar graph in my blog to help track my progress!

The ups and downs of trying to accumulate a seven-figure net worth on a five-figure salary, loose weight, get fit, do a post-grad course and launch a financial planning business - while working full-time.

Tuesday, 31 October 2006

Monday, 30 October 2006

Tax time blues - Part 2

Well, the Australian tax year runs from 1st July - 30th June, and the deadline for returns is 31st October. Way back on 14th August I wrote "Hopefully now that I've started using Quicken 2006 I'll be able to add in all the info for my current holdings over the next few months." - well, it never happened. What, with the birth of our second child in September, some uni assignments and doing too much blogging (!) I've never spent the time needed to enter all my expenses since 1 July as planned. What's worse is that I haven't brought my old share records in Quicken up to date, so I'm left with wading through my margin loan account statements to see what has been sold during the financial year, and then going through old records to work out the cost base.

Hopefully I'll get it all sorted out tonight and fill in the electronic eTax forms tomorrow so I can lodge it on time. As I'm owed a refund (I think) there probably wouldn't be a penalty for late lodgement, but I really want to get it over and done with. My new financial year's resolution is still to enter all my expenses into Quicken this year, and get my share records in Quicken up to date... we'll see how it goes.

tax

Hopefully I'll get it all sorted out tonight and fill in the electronic eTax forms tomorrow so I can lodge it on time. As I'm owed a refund (I think) there probably wouldn't be a penalty for late lodgement, but I really want to get it over and done with. My new financial year's resolution is still to enter all my expenses into Quicken this year, and get my share records in Quicken up to date... we'll see how it goes.

tax

Blog Monetization: Generating a Disclosure Policy

An important part monetization of a blog is to disclose to what degree your posts may be influenced by sponsorship. By disclosing the purpose of my blog, and to what extent I include sponsored content, and how it is tagged as such, I'm letting readers know more about the information they'll be reviewing. I retain the freedom to write original content, as well as select the advertisers I choose to post about in exchange for payment.

DisclosurePolicy.org has a nice Disclosure Policy Generator to help generate your customised policy. It takes only a few moments to answer a few questions, and the result is a disclosure policy, such as mine below:

This policy is valid from 30 October 2006

This blog is a personal blog written and edited by me. For questions about this blog, please contact enoughwealth@yahoo.com.

This blog accepts forms of cash advertising, sponsorship, paid insertions or other forms of compensation.

This blog abides by the WOMMA Word of Mouth Marketing Ethics Code. We believe in honesty of relationship, opinion and identity. The compensation received may influence the advertising content, topics or posts made in this blog. That content, advertising space or post will be clearly identified as paid or sponsored content.

The owner(s) of this blog is compensated to provide opinion on products, services, websites and various other topics. Even though the owner(s) of this blog receives compensation for our posts or advertisements, we always give our honest opinions, findings, beliefs, or experiences on those topics or products. The views and opinions expressed on this blog are purely the bloggers' own. Any product claim, statistic, quote or other representation about a product or service should be verified with the manufacturer, provider or party in question.

This blog does contain content which might present a conflict of interest. This content may not always be identified.

To get your own policy, go to http://www.disclosurepolicy.org

PayPerPost

DisclosurePolicy.org has a nice Disclosure Policy Generator to help generate your customised policy. It takes only a few moments to answer a few questions, and the result is a disclosure policy, such as mine below:

This policy is valid from 30 October 2006

This blog is a personal blog written and edited by me. For questions about this blog, please contact enoughwealth@yahoo.com.

This blog accepts forms of cash advertising, sponsorship, paid insertions or other forms of compensation.

This blog abides by the WOMMA Word of Mouth Marketing Ethics Code. We believe in honesty of relationship, opinion and identity. The compensation received may influence the advertising content, topics or posts made in this blog. That content, advertising space or post will be clearly identified as paid or sponsored content.

The owner(s) of this blog is compensated to provide opinion on products, services, websites and various other topics. Even though the owner(s) of this blog receives compensation for our posts or advertisements, we always give our honest opinions, findings, beliefs, or experiences on those topics or products. The views and opinions expressed on this blog are purely the bloggers' own. Any product claim, statistic, quote or other representation about a product or service should be verified with the manufacturer, provider or party in question.

This blog does contain content which might present a conflict of interest. This content may not always be identified.

To get your own policy, go to http://www.disclosurepolicy.org

PayPerPost

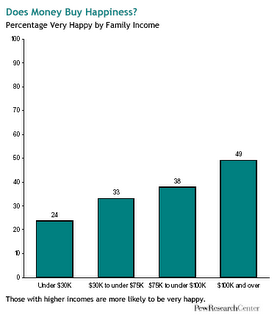

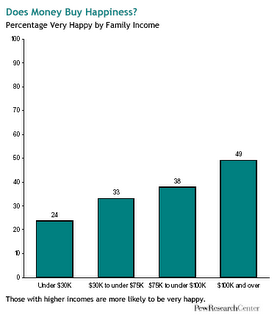

Money Myths: #1 - Money can't buy you happiness

Money can't buy everything, but there are lots of things that can be bought and which will increase your "happiness" level - for example, shelter, food, clothing, education and healthcare. Money is a tool, and it can be used to maximise happiness by spending on the things that are important to you. For example, if your kids getting a good education is important to you, you will be happier knowing that you are regularly saving in a college education fund, than you would be without. Similarly, if you want to provide for your family if anything happens to you, paying for life and disability insurance and having an emergency fund put aside will increase your level of happiness. And many people are happy to be able to afford charitable giving to those less fortunate than themselves.

When people say "money can't buy you happiness" they are generally thinking of people who are unhappy despite being "rich" - but they often forget that their current level of contentment relies on having sufficient money to satisfy their basic needs and some of their aspirations. A recent report issued by the

Pew Research Center found that of those surveyed 49 percent of repsondents with an annual family income of more than $100,000 said they were happy, while only 24 percent of respondents with an annual family income of less than $30,000 reported that they were happy. (The findings are drawn from a telephone survey of a nationally representative, randomly-selected sample of 3,014 adults, conducted from Oct. 5 through Nov. 6, 2005.)

Once you have enough income to take care of basic needs, any excess can be used to maximize your happiness. But in order to do this, you have to know what's important to you, and set some realistic goals. It's often best to put these goals down on paper, with dollar amounts required to achieve them, and a realistic time-frame. If you put down some milestones along the way, so much the better.

investing, money, wealth

When people say "money can't buy you happiness" they are generally thinking of people who are unhappy despite being "rich" - but they often forget that their current level of contentment relies on having sufficient money to satisfy their basic needs and some of their aspirations. A recent report issued by the

Pew Research Center found that of those surveyed 49 percent of repsondents with an annual family income of more than $100,000 said they were happy, while only 24 percent of respondents with an annual family income of less than $30,000 reported that they were happy. (The findings are drawn from a telephone survey of a nationally representative, randomly-selected sample of 3,014 adults, conducted from Oct. 5 through Nov. 6, 2005.)

Once you have enough income to take care of basic needs, any excess can be used to maximize your happiness. But in order to do this, you have to know what's important to you, and set some realistic goals. It's often best to put these goals down on paper, with dollar amounts required to achieve them, and a realistic time-frame. If you put down some milestones along the way, so much the better.

investing, money, wealth

Sunday, 29 October 2006

How to succeed with your budget!

The mechanics of creating a budget are well-known, and, while not very enjoyable for many people, not hard to complete. The difficulty lies in implementing and sticking to your budget. You can greatly increase your chance of sticking with your budget if you give careful thought to the CHANGES that need to be made to get from your old budget (starting position) and the new budget you hope to implement. Each change should be classified as either a ELIMINATION or a SUBSTITUTION.

An elimination is when you have to totally get rid of a particular spending behaviour - for example, quitting smoking or cutting up your credit card. These changes are very hard, and should only be done if absolutely necessary. A lot of changes SHOULD be classified as a substitution - for example, drinking filtered tap water and tea rather than softdrinks and Starbucks. These are usually much easier to implement as you are not having to eliminate a behaviour pattern 'cold turkey', but are still able to follow your normal routine with minor changes. Generally, after a week of substitution it will become a habit and can be followed without any further effort of will needed.

Many people make the mistake of classifying intended changes as an elimination when they should be aiming for a substitution instead. For example, if you wish to save on entertainment costs, it is far better to substitute your cable TV subscription with borrowing DVDs and books from your local library, substituting gym membership with lunchtime walks and so on. Trying to eliminate spending without introducing a suitable alterative will leave you in a permanent state of "deprivation" and you are more likely to fall back into old spending habits.

money, saving

An elimination is when you have to totally get rid of a particular spending behaviour - for example, quitting smoking or cutting up your credit card. These changes are very hard, and should only be done if absolutely necessary. A lot of changes SHOULD be classified as a substitution - for example, drinking filtered tap water and tea rather than softdrinks and Starbucks. These are usually much easier to implement as you are not having to eliminate a behaviour pattern 'cold turkey', but are still able to follow your normal routine with minor changes. Generally, after a week of substitution it will become a habit and can be followed without any further effort of will needed.

Many people make the mistake of classifying intended changes as an elimination when they should be aiming for a substitution instead. For example, if you wish to save on entertainment costs, it is far better to substitute your cable TV subscription with borrowing DVDs and books from your local library, substituting gym membership with lunchtime walks and so on. Trying to eliminate spending without introducing a suitable alterative will leave you in a permanent state of "deprivation" and you are more likely to fall back into old spending habits.

money, saving

Update: Blog Monetization

Well, so far my traffic is slowly building, but not enough to generate any significant revenue via ad clicks. However, the PayPerPost experiment is going quite well so far - I haven't met the 30 day requirement to actually get paid for any of the sponsored posts so far (first payment due in 16 days, fingers crossed), but there have been enough "opportunities" that were relevant to personal finance and I felt happy to blog about.

So far I have had a total of $30.00 "credit" for 5 posts - 3 approved ($21.00) and 2 still pending the OK. Generally it takes a few business days to get a new post approved.

If anyone would like to give PPP a try, you can use me as a referrer (enoughwealth@yahoo.com) when you sign up, and I'll get a $5.00 referral bonus!

I'll let you know when the first actual payment hits my Paypal account.

PayPerPost

So far I have had a total of $30.00 "credit" for 5 posts - 3 approved ($21.00) and 2 still pending the OK. Generally it takes a few business days to get a new post approved.

If anyone would like to give PPP a try, you can use me as a referrer (enoughwealth@yahoo.com) when you sign up, and I'll get a $5.00 referral bonus!

I'll let you know when the first actual payment hits my Paypal account.

PayPerPost

Six Things I Really Hate About PF

The six things I find most annoying in the realm of Personal Finance*:

1. Paying high fees and trailing commisions for mutual funds and insurance. The commision paid out of your first year's insurance premium is especially high (like up to 50%). And it seems that you generally can't even avoid such fees by buying "direct" from a fund or insurer.

2. That the "standard" fee structure for exotic investments such as Art Funds and Hedge Funds is 2/20 (2% MER plus 20% of any "surplus" performance, say above 6%) - since when does achieving a return of 7% justify a fee of 2.2%?

3. Mutual funds closing down when they perform badly for a few years (so that they can "bury" the bad performance figures). Often I'd like to have kept the investment open, and wait for an expected turn-around in the long-term (example: asian funds during the asian meltdown)

4. Small companies that need additional finance not giving their existing shareholders the opportunity to kick in more funds and retain ownership. eg. the company goes into administration/bankruptcy, sells out to a private investor for almost nothing, or accepts funding from a private investment company at an exhorbitant interest rate (often the interest is capitalised and eventually is paid out via a large issue of new shares to the investment company, which dilutes the existing shareholders stake tremendously).

5. Upper management costs - I've read that up to 10% of the profit of listed companies is spent on remuneration for the top 5 staff! I've nothing against reasonable payments, but there're too many examples of CEOs getting paid huge sums for mediocre performance, and then getting massive "golden handshakes" to terminate their contract "early". And don't get me started on payment of performance bonuses when a company is doing badly.

6. That 90% of what you read and see in the media about money and investments is absolute gibberish - and 90% of the audience has no idea.

* I haven't counted annoying things that were my own stupid fault, or just bad luck, such as investing in a stock that has lost money.

1. Paying high fees and trailing commisions for mutual funds and insurance. The commision paid out of your first year's insurance premium is especially high (like up to 50%). And it seems that you generally can't even avoid such fees by buying "direct" from a fund or insurer.

2. That the "standard" fee structure for exotic investments such as Art Funds and Hedge Funds is 2/20 (2% MER plus 20% of any "surplus" performance, say above 6%) - since when does achieving a return of 7% justify a fee of 2.2%?

3. Mutual funds closing down when they perform badly for a few years (so that they can "bury" the bad performance figures). Often I'd like to have kept the investment open, and wait for an expected turn-around in the long-term (example: asian funds during the asian meltdown)

4. Small companies that need additional finance not giving their existing shareholders the opportunity to kick in more funds and retain ownership. eg. the company goes into administration/bankruptcy, sells out to a private investor for almost nothing, or accepts funding from a private investment company at an exhorbitant interest rate (often the interest is capitalised and eventually is paid out via a large issue of new shares to the investment company, which dilutes the existing shareholders stake tremendously).

5. Upper management costs - I've read that up to 10% of the profit of listed companies is spent on remuneration for the top 5 staff! I've nothing against reasonable payments, but there're too many examples of CEOs getting paid huge sums for mediocre performance, and then getting massive "golden handshakes" to terminate their contract "early". And don't get me started on payment of performance bonuses when a company is doing badly.

6. That 90% of what you read and see in the media about money and investments is absolute gibberish - and 90% of the audience has no idea.

* I haven't counted annoying things that were my own stupid fault, or just bad luck, such as investing in a stock that has lost money.

Frugal living: photography is a low-cost hobby!

Wow, it's amazing how the "electronic age" has made some hobbies a LOT cheaper to indulge. For example, I bought my first SLR camera kit in the early 80s. Although the cost of the Pentax MX SLR and lenses was quite high, the real expense of this hobby was film and developing, not the mention negative slides, slide mounts, photo albumns etc. Although I enjoyed taking photos on holiday (after all, ten years after an overseas trip, the only thing you really have to show for spending thousands is a collection of photos and/or video) it was a bit too expensive to "practice" photography and experiment.

This has totally changed since digital cameras came out, and, especially now I have a digital Pentax *ist DL SLR (it may not be the best digital SLR, but it can be used with my existing collection of lenses and my telescope adaptor), I can take LOTS of photos, and it costs me practically nothing. In fact, being able to email pics to my relatives means that I'm saving money compared to having to get duplicate prints to mail.

It's also nice to be able to grab the digital SLR and take some quick pics and immediately see what they look like. For example, a frilly lizard has taken up residence in our yard, and is quite photogenic:

saving

This has totally changed since digital cameras came out, and, especially now I have a digital Pentax *ist DL SLR (it may not be the best digital SLR, but it can be used with my existing collection of lenses and my telescope adaptor), I can take LOTS of photos, and it costs me practically nothing. In fact, being able to email pics to my relatives means that I'm saving money compared to having to get duplicate prints to mail.

It's also nice to be able to grab the digital SLR and take some quick pics and immediately see what they look like. For example, a frilly lizard has taken up residence in our yard, and is quite photogenic:

saving

Saturday, 28 October 2006

AU shares: T3 share float

No, it's not the Terminator. Here in Oz the big investment buzz at the moment is regarding the goverment sell-off of their controlling stake in our telecom monolith - Telstra. They'd previously sold off chucks in the "T1" and "T2" offers several years ago. Unfortunately, T2 was sold at the peak of the dot.com bubble, so all the "mum and dad" investors who had made money buying T1 (at $3.30 a share in 1997), then lost a bundle buying T2 (at $7.40 a share) - unless they managed to sell at the peak of around $8.00. With Telstra currently around $3.65 a share, it'll be interesting to see how sucessful the T3 float is. The government isn't selling off it's entire remaining 51.8% stake in T3 - the base offer is 2.15 billion Telstra shares, or one-third of the Government's remaining 51.8 per cent stake, with the remainder to be dumped in the Future Fund (setup to eventually pay for unfunded public service pensions).

I bought T1, and then skipped T2 (I'd read enough about Dutch Tulips to avoid the dot.com frenzy). I've now applied for $10,000 worth of T3 shares. The first installment will cost $2 per share, with the remainder (based on the institutional book-build price, minus a 10c per share retail discount, plus a 1 per 25 bonus share issue when the 2nd installment is paid...) due in 18 months time. Telstra is currently paying a large dividend, so the ROI on the initial $2 installment is around 14% pa (plus tax credits due to dividend imputation). With the 10c discount and bonus share issue, the final cost of T3 shares should be around $3.25-$3.50 a share, although the final price won't be known until after a three-day institutional book-build set down for November 15 to 17.

Telstra is currently rapidly losing revenue as customers abandon the old landline phones in favour of mobile phones, and the mobile phone business is highly competitive. Whether T3 is a "cheap" buy at even $3.25 a share will all depend on how Telstra's cost cutting program works out, and how well they funnel cash flow into new business areas.

ps. It's interesting to read some of the misinformation that gets printed in the mainstream press - The Australian newspaper (one of our major national papers) printed on 10 Oct that T3 retail customers "will receive loyalty shares - a bonus issue of 25 shares for each 100 shares they retain". A pity that the propectus actually states that the loyalty share issue is 1 share for each 25 shares retained until then final installment is paid. Just a little difference of a 4% discount vs. a 25% discount! ;)

stocks

I bought T1, and then skipped T2 (I'd read enough about Dutch Tulips to avoid the dot.com frenzy). I've now applied for $10,000 worth of T3 shares. The first installment will cost $2 per share, with the remainder (based on the institutional book-build price, minus a 10c per share retail discount, plus a 1 per 25 bonus share issue when the 2nd installment is paid...) due in 18 months time. Telstra is currently paying a large dividend, so the ROI on the initial $2 installment is around 14% pa (plus tax credits due to dividend imputation). With the 10c discount and bonus share issue, the final cost of T3 shares should be around $3.25-$3.50 a share, although the final price won't be known until after a three-day institutional book-build set down for November 15 to 17.

Telstra is currently rapidly losing revenue as customers abandon the old landline phones in favour of mobile phones, and the mobile phone business is highly competitive. Whether T3 is a "cheap" buy at even $3.25 a share will all depend on how Telstra's cost cutting program works out, and how well they funnel cash flow into new business areas.

ps. It's interesting to read some of the misinformation that gets printed in the mainstream press - The Australian newspaper (one of our major national papers) printed on 10 Oct that T3 retail customers "will receive loyalty shares - a bonus issue of 25 shares for each 100 shares they retain". A pity that the propectus actually states that the loyalty share issue is 1 share for each 25 shares retained until then final installment is paid. Just a little difference of a 4% discount vs. a 25% discount! ;)

stocks

Frugal living: Comparison shopping

Online shoppers are increasingly using comparison shopping engines (CSEs) to compare the offerings of many merchants side by side in order to obtain the best possible price. Indeed, its been reported that between 25% and 75% of online purchases are influenced by comparison shopping.

For shoppers, websites such as www.buyfast.com.au and www.planetonline.com allow you to easily compare prices available for particular items. For online retail companies, software such as ShopTracker can be used to build, manage, categorize, and optimize products within shopping feeds at comparison shopping engines.

Using extremely comprehensive search engines, online comparison shopping sites allow shoppers to research and make purchasing decisions using information such as product descriptions, reviews, total price and product availability. Tools such as ShopTracker allow retailers to optimize product placement within the CSE's. For instance, the retailer can check if he/she is setting prices too high, effectively removing their products from the first page of results, or if the products are under priced compared to competitors, costing them revenue.

Basically, online shopping allows consumers to find a vast selection of merchandise and use the internet to find the lowest prices by searching multiple Websites and comparing offers. However, as more and more retailers have come online the amount of information, products and choices has become overwhelming. This has driven the next evolution of online shopping - online comparison shopping, and the growth of retailer tools such as ShopTracker.

Sponsored Post

For shoppers, websites such as www.buyfast.com.au and www.planetonline.com allow you to easily compare prices available for particular items. For online retail companies, software such as ShopTracker can be used to build, manage, categorize, and optimize products within shopping feeds at comparison shopping engines.

Using extremely comprehensive search engines, online comparison shopping sites allow shoppers to research and make purchasing decisions using information such as product descriptions, reviews, total price and product availability. Tools such as ShopTracker allow retailers to optimize product placement within the CSE's. For instance, the retailer can check if he/she is setting prices too high, effectively removing their products from the first page of results, or if the products are under priced compared to competitors, costing them revenue.

Basically, online shopping allows consumers to find a vast selection of merchandise and use the internet to find the lowest prices by searching multiple Websites and comparing offers. However, as more and more retailers have come online the amount of information, products and choices has become overwhelming. This has driven the next evolution of online shopping - online comparison shopping, and the growth of retailer tools such as ShopTracker.

Sponsored Post

Friday, 27 October 2006

Frugal living: Watch out for shopping trolley junk

While clipping petrol discount coupons off my "weekly" shopping dockets I decided to analyze my spending based on the dockets sitting in my wallet. Generally I just put the total amounts into Quicken, and track the total spent on "groceries" against my budget. But I realised that this doesn't really tell me WHAT I'm spending my grocery shopping budget on. I knew that I buy the odd snack/junk food or drink items, but I was shocked to find out exactly how much money I was wasting on these items:

The first thing that jumps out is that I'm shopping way too often (I tend to drop in to the supermarket nearly every second day while I'm collecting my mail from my post office box - this is NOT a good habit. I really should stick to one major shopping trip each week, and only get items that are on my shopping list).

The second thing is that spending 28% of the total on junk foods and drinks is ridiculous! I'm the one in our household that eats and drinks most of this junk, so I've no reason not to just eliminate this completely. This would save me around $2,500 a year AND be much better for my health. I think I'll add a new target to my blog - spend less than 5% of my grocery shopping on snack/junk food and drink.

money, saving

Analysis of my last 8 shopping dockets:

Total spend $351.86

Avg. spend per trip $ 43.98

Category Amount % of total

Household cleaning/laundry $20.07 5.70 %

Basic foodstuffs $190.06 54.02 %

Snack/Junk foods $50.78 14.43 %

Snack/Junk beverages $48.74 13.85 %

Medicines $10.82 3.08 %

Baby care $29.10 8.27 %

Toys/gifts $2.29 0.65 %

The first thing that jumps out is that I'm shopping way too often (I tend to drop in to the supermarket nearly every second day while I'm collecting my mail from my post office box - this is NOT a good habit. I really should stick to one major shopping trip each week, and only get items that are on my shopping list).Total spend $351.86

Avg. spend per trip $ 43.98

Category Amount % of total

Household cleaning/laundry $20.07 5.70 %

Basic foodstuffs $190.06 54.02 %

Snack/Junk foods $50.78 14.43 %

Snack/Junk beverages $48.74 13.85 %

Medicines $10.82 3.08 %

Baby care $29.10 8.27 %

Toys/gifts $2.29 0.65 %

The second thing is that spending 28% of the total on junk foods and drinks is ridiculous! I'm the one in our household that eats and drinks most of this junk, so I've no reason not to just eliminate this completely. This would save me around $2,500 a year AND be much better for my health. I think I'll add a new target to my blog - spend less than 5% of my grocery shopping on snack/junk food and drink.

money, saving

Frugal living: free "safe deposit" box

Keepyousafe.com has a great idea - users get a free small-sized Online Safe Deposit Box for one year, and can upgrade to a larger permanent box for as little as $3 per month. The key requirement for using online storage of your valuable records is that your stuff is "truly secure" as they say.

So far, their web site appears to still be in test mode - their "recent news" says:

And when you go to the FAQ page you get the following security warning:

which isn't critical, but would be off-putting to many potential customers.

Also, the FAQ itself consists simply of a message to "Please email support@keepyousafe.com for customer support."

I'll sign up for a free "small-sized" Online Safe Deposit Box to check out the service with some non-critical documents. It will be interesting to see how this service develops over the next few months.

PayPerPost

So far, their web site appears to still be in test mode - their "recent news" says:

Final testing of our Secure Online Safe Deposit Box has now been

successfully completed. Please re-visit us in the next two weeks as

new content is introduced on the site and press announcements are added.

successfully completed. Please re-visit us in the next two weeks as

new content is introduced on the site and press announcements are added.

And when you go to the FAQ page you get the following security warning:

which isn't critical, but would be off-putting to many potential customers.

Also, the FAQ itself consists simply of a message to "Please email support@keepyousafe.com for customer support."

I'll sign up for a free "small-sized" Online Safe Deposit Box to check out the service with some non-critical documents. It will be interesting to see how this service develops over the next few months.

PayPerPost

Income: Is higher education a good investment?

One of the fundamental tenants of wealth creation has always been to invest in your education. Latest figures (released Thursday by theUS Census Bureau) confirm this. The figures show that the average bachelor's degree is worth about $23,000 a year - that is the average gap in earnings between adults with bachelor's degrees and those with high school diplomas. College graduates made an average of $51,554 in 2004, compared with $28,645 for adults with a high school diploma, an average of $19,169 for those without a highschool diploma, and an average of $78,093 for those with an advanced college degree.

Of course, this study didn't determine how much of the increased earning power is due to having the intelligence to obtain the qualification, and how much is due to the education/qualification/networking of getting the further education.

The potential effect on your net worth is even greater than the raw salary figures suggest. There is a fixed "overhead" cost of living, so, assuming that you can exert some self-control and limit your spending as your salary increases, an increase in salary has a great effect on your ability to accumulate wealth. For example, if your basic cost of living is $30K pa, then a 50% pay rise from $40K to $60K has the potential to triple your ultimate net worth (saving and investing $30K rather than $10K pa).

personal finance, money, wealth

Of course, this study didn't determine how much of the increased earning power is due to having the intelligence to obtain the qualification, and how much is due to the education/qualification/networking of getting the further education.

The potential effect on your net worth is even greater than the raw salary figures suggest. There is a fixed "overhead" cost of living, so, assuming that you can exert some self-control and limit your spending as your salary increases, an increase in salary has a great effect on your ability to accumulate wealth. For example, if your basic cost of living is $30K pa, then a 50% pay rise from $40K to $60K has the potential to triple your ultimate net worth (saving and investing $30K rather than $10K pa).

personal finance, money, wealth

Blog Monetization: Building Traffic

James Brausch has some interesting tips on how to build up blog traffic at his Internet business site. One of the more interesting articles is "Why Article Marketing Is My #1 Traffic Strategy" - where he outlines how to build traffic by writing an article, and, by mixing and matching several different versions (swapping variations of the same paragraph) you can generate hundreds of "unique" content articles for submission. Unfortunately he doesn't provide much info on where to submit your articles - for that you'd have to buy he software "Artemis Pro" for $105! As I can easily write a macro in excel to mix 'n match article paragraphs to create "unique" content, it's just a question of how much time it would take to manually track down article submission sites and manually submit my articles. I'll do a bit of research on this and see if it's worth spending the $105. I suppose it all depends on how monetized your site is, and whether the increased traffic justifies the cost.

PayPerPost

PayPerPost

Thursday, 26 October 2006

Medical Expenses

I had to see the doctor twice last week. The first "long" consultation (about 20 mins) cost $80, and the follow-up visit (a "short" consultation of around 10 mins) cost $50. Because I'd registered my banking details with the practice, my Medicare rebate was paid electronically into my bank account the next business day after I'd paid each bill using my day-to-day credit card. I got $59.70 refund from Medicare for the long consult, and $31.45 back for the short consult - overall a refund of 70% of the total doctor's bill. It's nice to get some of my tax dollars back, but I'd rather not be sick in the first place! The presciption medications cost me a total of $88.50 - each item costing just the $29.50 PBS (Pharmaceutical Benefits Scheme) subsidised price. I'm not sure how much it each item actually costs the government, but I'm sure it's well over twice the PBS price.

Ending up around $130 out-of-pocket for half an hour of a GPs time and several hundred dollars worth of medicine seems like a bargain. While I can see that this would still be a large cost for a "working poor" family, I believe some small co-payment should be required from all patients - say, $5 from the bulk-billed patients for each visit to the doctor. Most doctor's still "bulk-bill" pensioner patients, in which case the patient pays nothing, and the doctor gets a slightly reduced amount from medicare. A small co-payment would discourage overservicing - such as lonely pensioners visiting the doctor just for a chat!

Ending up around $130 out-of-pocket for half an hour of a GPs time and several hundred dollars worth of medicine seems like a bargain. While I can see that this would still be a large cost for a "working poor" family, I believe some small co-payment should be required from all patients - say, $5 from the bulk-billed patients for each visit to the doctor. Most doctor's still "bulk-bill" pensioner patients, in which case the patient pays nothing, and the doctor gets a slightly reduced amount from medicare. A small co-payment would discourage overservicing - such as lonely pensioners visiting the doctor just for a chat!

Gearing: Risk vs. Reward - the last 10 years

Using gearing to increase your returns in the long term has a couple of problems:

1) The interest rate charged directly impacts on the extra return generated

2) The extra risk (volatility) generated by gearing is large compared to the extra return

To get a better feel for how good a strategy gearing is, I've first looked at the current interest rates available for margin loans (and how it depends on the amount borrowed) and the current spread between the margin lending interest rate and the target cash rate set by the reserve bank.

The graph shows that the interest rate charged on a margin loan varies considerably between the different margin lenders, so it pays to shop around. Generally, the interest rate is reduced for clients with a large loan balance, so it's probably worth having one large loan rather than spreading it between several lenders (this is something I need to fix over time, as I currently have three different margin loan accounts. The problem is the tax effect of realising capital gains when transferring holdings from one lender to another).

It can be seen that the current spread between the target cash rate (6.00%) and the typical margin loan interest rate on a $500,000 loan is about 2.5% - so I've assumed this was the typical spread during the past ten years or so.

I've then used the changes in the target cash rate over the past decade (see below) to calculate the average margin loan interest rate each year since 1997, and compared that to the change in the All Ordinaries Index each year:

This table confirms that the use of gearing would have boosted your returns during the past decade - from an average of 8.13% pa without gearing, to 8.62% using 100% debt:equity (a 50% loan:value ratio), and 9.11% using a higher gearing rate of 67% LVR (close to the normal lending limit of 70%).

However, it also clearly shows that the use of gearing greatly magnified the ups and downs of a portfolio - the relatively modest 11.47% drop during 2002 would have meant a 48.53% drop in value of a portfolio using 67% LVR, and probably would have required more cash being added into the account to avoid getting a margin call.

In the long term, getting a return of 9.11% instead of 8.13% will have a large effect on your final net worth - if inflation averaged 3% this would result in a real return of 6.11% rather than 5.13% (an improvement of 19%).

It is important to watch your LVR when using gearing, be conservative when the market is setting new highs, and be prepared to manage your portfolio to avoid any margin calls. It is also very important to shop around for the best possible interest rate - possibly using home equity to obtain lower rates.

personal finance, investing, investment, stocks

1) The interest rate charged directly impacts on the extra return generated

2) The extra risk (volatility) generated by gearing is large compared to the extra return

To get a better feel for how good a strategy gearing is, I've first looked at the current interest rates available for margin loans (and how it depends on the amount borrowed) and the current spread between the margin lending interest rate and the target cash rate set by the reserve bank.

The graph shows that the interest rate charged on a margin loan varies considerably between the different margin lenders, so it pays to shop around. Generally, the interest rate is reduced for clients with a large loan balance, so it's probably worth having one large loan rather than spreading it between several lenders (this is something I need to fix over time, as I currently have three different margin loan accounts. The problem is the tax effect of realising capital gains when transferring holdings from one lender to another).

It can be seen that the current spread between the target cash rate (6.00%) and the typical margin loan interest rate on a $500,000 loan is about 2.5% - so I've assumed this was the typical spread during the past ten years or so.

I've then used the changes in the target cash rate over the past decade (see below) to calculate the average margin loan interest rate each year since 1997, and compared that to the change in the All Ordinaries Index each year:

Average ----with gearing----

Year cash ML XAO XAO % % gain w/out 50% LVR 67% LVR

rate rate start end change or loss ML 100% D:E 200% D:E

1997 5.48% 7.98% 2411.2 2609.1 8.21% 0.23% 8.21% 8.43% 8.66%

1998 4.98% 7.48% 2609.1 2832.6 8.57% 1.09% 8.57% 9.65% 10.74%

1999 4.79% 7.29% 2832.6 3124.1 10.29% 3.00% 10.29% 13.29% 16.29%

2000 5.93% 8.43% 3124.1 3205.4 2.60% -5.83% 2.60% -3.22% -9.05%

2001 5.06% 7.56% 3205.4 3384.5 5.59% -1.97% 5.59% 3.61% 1.64%

2002 4.56% 7.06% 3384.5 2996.2 -11.47% -18.53% -11.47% -30.00% -48.53%

2003 4.81% 7.31% 2996.2 3309.8 10.47% 3.16% 10.47% 13.62% 16.78%

2004 5.25% 7.75% 3309.8 4060.7 22.69% 14.94% 22.69% 37.62% 52.56%

2005 5.46% 7.96% 4060.7 4721.1 16.26% 8.30% 16.26% 24.57% 32.87%

AVG 8.13% 0.49% 8.13% 8.62% 9.11%

Average ----with gearing----

Year cash ML XAO XAO % % gain w/out 50% LVR 67% LVR

rate rate start end change or loss ML 100% D:E 200% D:E

1997 5.48% 7.98% 2411.2 2609.1 8.21% 0.23% 8.21% 8.43% 8.66%

1998 4.98% 7.48% 2609.1 2832.6 8.57% 1.09% 8.57% 9.65% 10.74%

1999 4.79% 7.29% 2832.6 3124.1 10.29% 3.00% 10.29% 13.29% 16.29%

2000 5.93% 8.43% 3124.1 3205.4 2.60% -5.83% 2.60% -3.22% -9.05%

2001 5.06% 7.56% 3205.4 3384.5 5.59% -1.97% 5.59% 3.61% 1.64%

2002 4.56% 7.06% 3384.5 2996.2 -11.47% -18.53% -11.47% -30.00% -48.53%

2003 4.81% 7.31% 2996.2 3309.8 10.47% 3.16% 10.47% 13.62% 16.78%

2004 5.25% 7.75% 3309.8 4060.7 22.69% 14.94% 22.69% 37.62% 52.56%

2005 5.46% 7.96% 4060.7 4721.1 16.26% 8.30% 16.26% 24.57% 32.87%

AVG 8.13% 0.49% 8.13% 8.62% 9.11%

This table confirms that the use of gearing would have boosted your returns during the past decade - from an average of 8.13% pa without gearing, to 8.62% using 100% debt:equity (a 50% loan:value ratio), and 9.11% using a higher gearing rate of 67% LVR (close to the normal lending limit of 70%).

However, it also clearly shows that the use of gearing greatly magnified the ups and downs of a portfolio - the relatively modest 11.47% drop during 2002 would have meant a 48.53% drop in value of a portfolio using 67% LVR, and probably would have required more cash being added into the account to avoid getting a margin call.

In the long term, getting a return of 9.11% instead of 8.13% will have a large effect on your final net worth - if inflation averaged 3% this would result in a real return of 6.11% rather than 5.13% (an improvement of 19%).

It is important to watch your LVR when using gearing, be conservative when the market is setting new highs, and be prepared to manage your portfolio to avoid any margin calls. It is also very important to shop around for the best possible interest rate - possibly using home equity to obtain lower rates.

personal finance, investing, investment, stocks

Wednesday, 25 October 2006

Frugal living: getting paid to exercise

I used to have a gym membership, but after the gym located on my route home from work closed down I didn't bother looking for another gym. I simply walked half an hour each lunchtime at work which saved me at least $10 a week in gym fees.

Later on I helped my son do a paper round before school/work. This involved a 2 hour walk (starting at 6am) 5 days a week, and earned my son around $95 a week - it's much better getting paid for exercising than having to pay a gym fee! I also found that I got more exercise that way, as we couldn't skip a session if I wasn't in the mood.

Also, because my son was earning an income, he was eligible to contribute $1,000 into his own retirement savings account (RSA) and receive a $1,500 superannuation co-contribution from the government. Hence the net benefit of getting paid to exercise was me saving $520 pa and my son adding $6,440 pa to his net worth.

I stopped doing the paper round just before the arrival of our second child last month - getting up a 5:30am doesn't fit in well with disturbed nights and dirty nappies! I'll now have to get back in to the routine of daily lunchtime walks, and swimming during the summer months. Later on we'll look for some weekend work delivering flyers to peoples letter boxes - because our local paper has to be delivered before school each day it's not a viable long term job for a school boy and his poor, old dad!

personal finance, money, retirement

Later on I helped my son do a paper round before school/work. This involved a 2 hour walk (starting at 6am) 5 days a week, and earned my son around $95 a week - it's much better getting paid for exercising than having to pay a gym fee! I also found that I got more exercise that way, as we couldn't skip a session if I wasn't in the mood.

Also, because my son was earning an income, he was eligible to contribute $1,000 into his own retirement savings account (RSA) and receive a $1,500 superannuation co-contribution from the government. Hence the net benefit of getting paid to exercise was me saving $520 pa and my son adding $6,440 pa to his net worth.

I stopped doing the paper round just before the arrival of our second child last month - getting up a 5:30am doesn't fit in well with disturbed nights and dirty nappies! I'll now have to get back in to the routine of daily lunchtime walks, and swimming during the summer months. Later on we'll look for some weekend work delivering flyers to peoples letter boxes - because our local paper has to be delivered before school each day it's not a viable long term job for a school boy and his poor, old dad!

personal finance, money, retirement

Tuesday, 24 October 2006

If I was a rich man

I've always had a fascination with castles, knights and the whole medieval lifestyle thing. I'd love to buy a slightly run-down but livable manor house, and I even went so far as to tender an offer for a manor house in Scotland a few years ago - unfortunately although the advert in Country Life had said "offers over 150,000 pounds" (around AUD $375,000), it quickly became apparent that a realistic price was over 400,000 pounds. In the end my father and I made an offer of just under 400,000 pounds which wasn't accepted. I think the property sold for around 450,000 pounds or so - a bit out of my league. It's also a large chunk of capital to invest in an asset that doesn't tend to appreciate much over the inflation rate - although country houses in the UK have boomed in the past few years, boosted by price increases in the cities.

These days I still browse through the Country Life ads looking for a bargain, and I even look at properties in Eastern Europe and at buying a property in Spain - although I'd rather buy in the UK as I know the language and legal system. It gives me something to daydream about while waiting for the magic of compound interest to do it's work on my investment portfolio.

PayPerPost

These days I still browse through the Country Life ads looking for a bargain, and I even look at properties in Eastern Europe and at buying a property in Spain - although I'd rather buy in the UK as I know the language and legal system. It gives me something to daydream about while waiting for the magic of compound interest to do it's work on my investment portfolio.

PayPerPost

Retirement Fund Asset Mix

I generally think a 40% domestic shares, 35% foreign shares, 15% property, 10% bonds is the basic starting point for working out a long-term investment mix, provided this weighting towards growth assets matches your risk tolerance. Since my retirement fund is definitely a long-term investment(20 years till retirement age, then maybe another 20 or so during retirement) this was my starting point. I did decrease my weighting in shares and increase the % in property during the bear market in 2001, and then weighted my asset mix more towards shares in 2003 when the market seemed to have bottomed out.

My current investment mix in my retirement account is as follows

Overall the asset allocation works out as:

The cash component isn't really intentional - it's just that all the stock funds tend to have a cash float at all times. I've got less in bonds than my "plan" requires - but with interest rates still quite low the risk of capital loss with bond investments seems more towards the upside, and the coupon rate is nothing too exciting. If interest rates here go up another 0.25% or .50% and the economy slows down, I'll reweight from stocks to bonds. I think my "model" retirement portfolio is around 40% AU shares:35% INT shares:15% LPT:10% bonds:0% cash

Hopefully these Asset classes should return something like the following in the long term:

This would give my "model" portfolio an expected return of around 8.65% (after fees and charges)

personal finance, investing, investment, stocks, real estate

My current investment mix in my retirement account is as follows

BT Business Superannuation

Investment Option wt %

Colonial First State Diversified 1.91%

Westpac Australian Shares 19.68%

Colonial First State Australian Shares 25.53%

Westpac International Shares 1.93%

BT Core Global Shares 20.48%

MLC Global Share 20.13%

Westpac Australian Property Securities 10.26%

Westpac Australian Fixed Interest 0.06%

Intech High Opportunity 0.03%

Overall the asset allocation works out as:

Asset class wt %

Australian Shares 43.52%

International Shares 37.93%

Property 10.13%

Bonds 0.38%

Cash 8.03%

The cash component isn't really intentional - it's just that all the stock funds tend to have a cash float at all times. I've got less in bonds than my "plan" requires - but with interest rates still quite low the risk of capital loss with bond investments seems more towards the upside, and the coupon rate is nothing too exciting. If interest rates here go up another 0.25% or .50% and the economy slows down, I'll reweight from stocks to bonds. I think my "model" retirement portfolio is around 40% AU shares:35% INT shares:15% LPT:10% bonds:0% cash

Hopefully these Asset classes should return something like the following in the long term:

Asset class return %

Australian Shares 9.5%

International Shares 9.0%

Property 8.0%

Bonds 5.0%

Cash 3.5%

This would give my "model" portfolio an expected return of around 8.65% (after fees and charges)

personal finance, investing, investment, stocks, real estate

Monday, 23 October 2006

Festival of Stocks - lots of great posts

The latest Festival of Stocks (#7) is now available at Gold Stock Bull. It has 11 great posts ranging for individual stocks such as Apple and Microsoft, Sectors like Australian banks, all the way up to how to capitalize on China’s growing consumerism.

Asset Class - Fine Art

The lack of correlation between the stock market and the art market makes Fine Art a possibly attractive asset class to use to diversify a portfolio beyond the traditional stocks, bonds and real estate. However, while art can hedge against some of the movements in the stock market, it has a similar level of risk and, for most individuals, it is too expensive to invest in individual art works. Even funds such as the popular London-based Fine Art Fund require investors to hand over a minimum of $250,000 in order to play the art market. And those investors will have to be willing to wait at least three years before they can cash out of their investment.

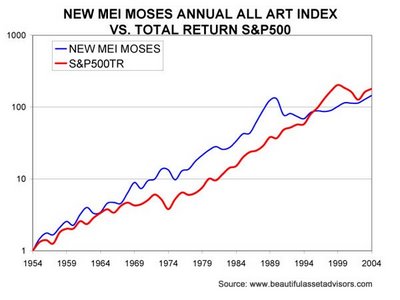

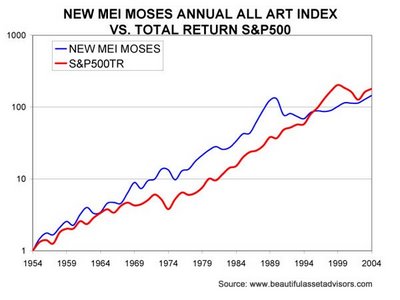

How has Fine Art performed as an asset class compared to, say, stocks? The Mei/Moses Fine Art Index, the creation of NYU Stern School of Business finance professors Jiangping Mei and Michael Moses, tracks 9,000 pieces of art that were auctioned by Sotheby's and Christie's since 1950. The index measures the value of the art market by analyzing repeat sales of the different pieces of art that comprise the index. While it is generally considered a fair benchmark for art valuation, it excludes transaction fees, works that fail to sell at auction and certain styles of art, such as photography and prints.

Over the last 50 years, stocks (as represented by the S&P 500) returned 10.9 percent annually, while the art index returned 10.5 percent per annum. As can be seen below, there is a low covariance between the Art Index and the S&P500 index:

One of the problems of consideraing Fine Art as an investment asset class is that in the art market, only about 30% to 50% of the works that change hands in any given year do so on the open market, at auction, where the public can see the prices. In the contemporary market, that figure plunges into the single digits. In addition, access to the market isn't always easy or cheap -- the supply of contemporary works is controlled by dealers, for instance, while hefty auction fees make it hard to compare the art market to any securities market. Therefore, the entry fee and management fees of any Art Fund are likely to be high - similar to that of Hedge Funds, but with performance that has historically been more in line with the stock market.

How has Fine Art performed as an asset class compared to, say, stocks? The Mei/Moses Fine Art Index, the creation of NYU Stern School of Business finance professors Jiangping Mei and Michael Moses, tracks 9,000 pieces of art that were auctioned by Sotheby's and Christie's since 1950. The index measures the value of the art market by analyzing repeat sales of the different pieces of art that comprise the index. While it is generally considered a fair benchmark for art valuation, it excludes transaction fees, works that fail to sell at auction and certain styles of art, such as photography and prints.

Over the last 50 years, stocks (as represented by the S&P 500) returned 10.9 percent annually, while the art index returned 10.5 percent per annum. As can be seen below, there is a low covariance between the Art Index and the S&P500 index:

One of the problems of consideraing Fine Art as an investment asset class is that in the art market, only about 30% to 50% of the works that change hands in any given year do so on the open market, at auction, where the public can see the prices. In the contemporary market, that figure plunges into the single digits. In addition, access to the market isn't always easy or cheap -- the supply of contemporary works is controlled by dealers, for instance, while hefty auction fees make it hard to compare the art market to any securities market. Therefore, the entry fee and management fees of any Art Fund are likely to be high - similar to that of Hedge Funds, but with performance that has historically been more in line with the stock market.

Sunday, 22 October 2006

Some thoughts about the use of gearing

How can you use gearing as part of your investment strategy? I hope to increase the returns of my portfolio with the least possible increase in risk by using borrowed funds to increase my investment. A simple example would be to invest a total of $200,000 in an index fund (eg. Vanguard) via a margin lending account, so that you've put in $100,000 of your own savings, and have borrowed the other $100,000 from the lender. The income from the $200,000 investment would cover part of the interest on the borrowed $100,000. Any extra I have to kick in from my cash flow to cover interest payments is tax deductible.

I prefer this approach (use of gearing) to that of boosting returns by including more risky assets in my portfolio because, theoretically, using gearing can provide more increase in return for an increased level of risk than just including a larger proportion of high-risk, high-return assets in your portfolio. Apparently it has something to do with the tangent of the line from the interest rate on the borrowed funds to the point on the efficient frontier corresponding to your asset mix having a steeper slope compared to just moving along the efficient frontier... Don't ask me to explain! As far as I can tell it looks something like the diagram below:

The idea is that you can increase the return of your "efficient" portfolio more by taking on extra risk through the use of gearing (ie. along the red line) than by changing the asset mix to include more risky assets (moving along the efficient frontier, assuming you have the right asset mix).

I don't worry too much about the details, as the entire concept of the efficient frontier seems fairly academic. In practice, you don't have precise data about all the assets in your portfolio (historic standard deviation, return, and covariance for all of the assets in your portfolio) or for determining the efficient frontier (such data on all possible assets mixes). Also, the usual problem of predicting the future using historic data applies. In practice, it seems that a sensible, well-diversified asset mix lies pretty close to the efficient frontier, and the use of gearing will be preferable to the inclusion of more risky assets in your portfolio (provided the interest rate on your investment loan isn't too high).

The other benefit of using gearing is that by having a larger total investment you are more able to make use of diversification.

Several things about the use of gearing (borrowing to invest) seem important to me:

1. You have to manage your risk - it is stupid (very risky) to borrow to invest in just one particular stock, or sector (eg. tech, oil, bio etc). I was amazed to learn that around 15% of margin loans are for accounts that have only one stock in them! The chances are you are not the next Warren Buffet (I know I'm not), so it's much more sensible to diversify - either via a portfolio of at least 10-12 stocks (not all in the same sector), or else via an index fund. Or a combination of both.

2. You have to borrow at the best possible interest rate - over time I've opened new margin lending accounts with lenders that offer a lower interest rate and that allow you to trade on your margin account via an online discount broker. Interest rates may be lower if you borrow a larger amount. I also have a margin lending account with the bank that provided my home and investment property loans - as a preferred customer I get 0.25% knocked of the standard interest rate. Most recently I used a "portfolio loan" secured against the equity in my real estate assets (similar to a HELOC?) to borrow at the standard home loan rate and invest in a portfolio of US shares (see my posts about my "Little Book" portfolio).

3. You should borrow less than the maximum so that you have a buffer against getting a margin call when the next market correction/bear market/crash happens. If the average margin for the stocks in your margin lending account is 70%, then you probably shouldn't get your loan-to-value ratio (LVR) above 50%.

The table below shows what % drop in the market would trigger a margin call for different starting values of gearing:

Gearing is basically the "muplitplier effect" that will apply to any losses or gains made by the portfolio on your equity. For example, if the gearing used is 2.0, then if your portfolio went up 10% your equity will have increased 20%. Similarly, if the market "corrected" -15% causing your portfolio to drop -15%, your equity will have gone down by -30%.

As the loan amount stays constant, any drop in the value of your portfolio will decrease the margin value (eg. 70% of the portfolio value). This also means that your margin utilisation increases. Most lenders will give you a "margin call" if your margin utilisation exceeds 100%. (There's often a "buffer" of 5%, so you'd get a margin call if the MU was >105%). When you get a margin call you have to bring your MU back down to less than 100%. This can be done in several ways:

* put some cash into your account (ie. pay off some of the loan) - this is best

* put in some stocks (eg. if you had some unencumbered stocks you could add into the margin account) - this is second best, as only the margin value of the stock (say, 70%) counts.

* sell off some stocks - you may not want to sell at the price prevailing when you get a margin call.

The most interesting column in the table is the % drop required to trigger a margin call. Looking at daily closing price data for the Australian All-Ordinaries Index (similar to the S&P500), I calculated the maximum % drop ever experienced after buying on any particular date for the past ten years. This period doesn't include any once-in-a-lifetime crash like '87 or '29, but does include the major bear market of the early noughties. I then grouped all the maximum decreases into bands - for the 2,531 days studied (1996-2006) I counted how many times the maximum drop was 0-5%, how many times it was in the range 5-10 % and so on. The tabulated results are:

This shows that, at least for this past ten year period, if you'd invested on any randomly selected day for had a small (4.1%) chance of experiencing a drop of 20-25% before things began to improve.

You had a much bigger chance (21.4%) of experiencing a drop of over 15%. And drops of less than 15% are quite common.

This emphasises why it is important not to use excessive gearing - you have a significant liklihood of getting a margin call if your LVR is much over 60% (remember, an 18.3% drop will trigger a margin call if your LVR was 60%). Using gearing conservatively (say less than 50% LVR) with a well-diversified portfolio reduces the chance of a margin call significantly.

My plan is to maintain an LVR of around 50%, giving me a gearing ratio of 2. Assuming I can borrow funds at around 7.5% on average, and my portfolio return averages around 9.0%, I would expect my return on equity (ROE) to be 9.0% + (9.0% - 7.5%) = 10.5%. Assuming inflation averages around 3.0%, this extra 1.5% return would mean my real (after inflation) return is increased by 33% using fairly modest gearing. And this would have a big impact on the final balance.

I prefer this approach (use of gearing) to that of boosting returns by including more risky assets in my portfolio because, theoretically, using gearing can provide more increase in return for an increased level of risk than just including a larger proportion of high-risk, high-return assets in your portfolio. Apparently it has something to do with the tangent of the line from the interest rate on the borrowed funds to the point on the efficient frontier corresponding to your asset mix having a steeper slope compared to just moving along the efficient frontier... Don't ask me to explain! As far as I can tell it looks something like the diagram below:

The idea is that you can increase the return of your "efficient" portfolio more by taking on extra risk through the use of gearing (ie. along the red line) than by changing the asset mix to include more risky assets (moving along the efficient frontier, assuming you have the right asset mix).

I don't worry too much about the details, as the entire concept of the efficient frontier seems fairly academic. In practice, you don't have precise data about all the assets in your portfolio (historic standard deviation, return, and covariance for all of the assets in your portfolio) or for determining the efficient frontier (such data on all possible assets mixes). Also, the usual problem of predicting the future using historic data applies. In practice, it seems that a sensible, well-diversified asset mix lies pretty close to the efficient frontier, and the use of gearing will be preferable to the inclusion of more risky assets in your portfolio (provided the interest rate on your investment loan isn't too high).

The other benefit of using gearing is that by having a larger total investment you are more able to make use of diversification.

Several things about the use of gearing (borrowing to invest) seem important to me:

1. You have to manage your risk - it is stupid (very risky) to borrow to invest in just one particular stock, or sector (eg. tech, oil, bio etc). I was amazed to learn that around 15% of margin loans are for accounts that have only one stock in them! The chances are you are not the next Warren Buffet (I know I'm not), so it's much more sensible to diversify - either via a portfolio of at least 10-12 stocks (not all in the same sector), or else via an index fund. Or a combination of both.

2. You have to borrow at the best possible interest rate - over time I've opened new margin lending accounts with lenders that offer a lower interest rate and that allow you to trade on your margin account via an online discount broker. Interest rates may be lower if you borrow a larger amount. I also have a margin lending account with the bank that provided my home and investment property loans - as a preferred customer I get 0.25% knocked of the standard interest rate. Most recently I used a "portfolio loan" secured against the equity in my real estate assets (similar to a HELOC?) to borrow at the standard home loan rate and invest in a portfolio of US shares (see my posts about my "Little Book" portfolio).

3. You should borrow less than the maximum so that you have a buffer against getting a margin call when the next market correction/bear market/crash happens. If the average margin for the stocks in your margin lending account is 70%, then you probably shouldn't get your loan-to-value ratio (LVR) above 50%.

The table below shows what % drop in the market would trigger a margin call for different starting values of gearing:

Assumptions:

Average 70% margin

Margin Call occurs if loan > 105% of margin value

% drop to initial initial initial

Capital Loan Total get a call LVR MU DER gearing

$100,000 $ 50,000 $150,000 54.6% 33.3% 47.6% 50.0% 1.5

$100,000 $ 60,000 $160,000 48.9% 37.5% 53.6% 60.0% 1.6

$100,000 $ 70,000 $170,000 43.9% 41.2% 58.8% 70.0% 1.7

$100,000 $ 80,000 $180,000 39.5% 44.4% 63.5% 80.0% 1.8

$100,000 $ 90,000 $190,000 35.5% 47.4% 67.7% 90.0% 1.9

$100,000 $100,000 $200,000 31.9% 50.0% 71.4% 100.0% 2.0

$100,000 $110,000 $210,000 28.7% 52.4% 74.8% 110.0% 2.1

$100,000 $120,000 $220,000 25.7% 54.5% 77.9% 120.0% 2.2

$100,000 $130,000 $230,000 23.0% 56.5% 80.7% 130.0% 2.3

$100,000 $140,000 $240,000 20.6% 58.3% 83.3% 140.0% 2.4

$100,000 $150,000 $250,000 18.3% 60.0% 85.7% 150.0% 2.5

LVR = loan-to-value ration (amount borrowed / total value of portfolio)

MU = margin utilisation (amount borrowed / max. amount allowed)

DER = debt-to-equity ratio (amount borrowed / your equity)

Gearing is basically the "muplitplier effect" that will apply to any losses or gains made by the portfolio on your equity. For example, if the gearing used is 2.0, then if your portfolio went up 10% your equity will have increased 20%. Similarly, if the market "corrected" -15% causing your portfolio to drop -15%, your equity will have gone down by -30%.

As the loan amount stays constant, any drop in the value of your portfolio will decrease the margin value (eg. 70% of the portfolio value). This also means that your margin utilisation increases. Most lenders will give you a "margin call" if your margin utilisation exceeds 100%. (There's often a "buffer" of 5%, so you'd get a margin call if the MU was >105%). When you get a margin call you have to bring your MU back down to less than 100%. This can be done in several ways:

* put some cash into your account (ie. pay off some of the loan) - this is best

* put in some stocks (eg. if you had some unencumbered stocks you could add into the margin account) - this is second best, as only the margin value of the stock (say, 70%) counts.

* sell off some stocks - you may not want to sell at the price prevailing when you get a margin call.

The most interesting column in the table is the % drop required to trigger a margin call. Looking at daily closing price data for the Australian All-Ordinaries Index (similar to the S&P500), I calculated the maximum % drop ever experienced after buying on any particular date for the past ten years. This period doesn't include any once-in-a-lifetime crash like '87 or '29, but does include the major bear market of the early noughties. I then grouped all the maximum decreases into bands - for the 2,531 days studied (1996-2006) I counted how many times the maximum drop was 0-5%, how many times it was in the range 5-10 % and so on. The tabulated results are:

max drop count probability

0% - 5% 1,069 42.2%

5% - 10% 438 17.3%

10% - 15% 480 19.0%

15% - 20% 439 17.3%

20% - 25% 105 4.1%

25% - 30% 0 0.0%

30% - 35% 0 0.0%

35% - 40% 0 0.0%

>40% 0 0.0%

TOTAL 2,531 100.0%

This shows that, at least for this past ten year period, if you'd invested on any randomly selected day for had a small (4.1%) chance of experiencing a drop of 20-25% before things began to improve.

You had a much bigger chance (21.4%) of experiencing a drop of over 15%. And drops of less than 15% are quite common.

This emphasises why it is important not to use excessive gearing - you have a significant liklihood of getting a margin call if your LVR is much over 60% (remember, an 18.3% drop will trigger a margin call if your LVR was 60%). Using gearing conservatively (say less than 50% LVR) with a well-diversified portfolio reduces the chance of a margin call significantly.

My plan is to maintain an LVR of around 50%, giving me a gearing ratio of 2. Assuming I can borrow funds at around 7.5% on average, and my portfolio return averages around 9.0%, I would expect my return on equity (ROE) to be 9.0% + (9.0% - 7.5%) = 10.5%. Assuming inflation averages around 3.0%, this extra 1.5% return would mean my real (after inflation) return is increased by 33% using fairly modest gearing. And this would have a big impact on the final balance.

Saturday, 21 October 2006

PPP - Blue Monster 178

PayPerPost has just released another piece of the images required for their "payperpostbluemonster" puzzle competition, which will be starting soon! Check out the PayPerPost site for more details about their blog marketing approach.

The competition image piece is this:

It is a puzzle piece for a contest that will be announced in the near future. The first person to reassemble all the pieces and post it on their blog will get paid a $500 opportunity fee.

Best luck with the competition!

PayPerPost

The competition image piece is this:

It is a puzzle piece for a contest that will be announced in the near future. The first person to reassemble all the pieces and post it on their blog will get paid a $500 opportunity fee.

Best luck with the competition!

PayPerPost

6 Ways to NOT Scam yourself into Saving

I just read the Fugal Duchess' "6 Ways I Scam Myself into Saving" and although it's an entertaining post I have to disagree with each one of her 6 ideas - I'll explain why.

1. Hide-don't-Seek: I do this occasional by accident, and any "found" money goes into the kids money box as extra pocket money (My eldest son saves 100% of his pocketmoney anyhow, so it's a good deal). I would NOT do this scam intentionally as a) you risk losing notes if you just stuff bills into your pockets!, and b) how are you going to learn GOOD spending behaviour if you just avoid the effort?

2. Break the Bill: I do the exact opposite - I try to never take out cash (I use my day-to-day credit card for grocery shopping at the supermarket, doctors visits, bill payments etc. so I earn points - an extra 1% or so saving). When I have to take out cash (to make a payment that doesn't take credit cards, or charges a surcharge for payment by CC) I will then keep all the bills unbroken for as long as possible. I've trained myself hate having to hand over a nice whole bill and get a measly handful of "shrapnel" back. Also, having a random mix of small notes and many coins makes it hard to track exactly what you have spent each day and I find the money will magically disappear over a week if I don't keep an eagle-eye on it!

3. The Break-the-Bank trick: I've nothing against using banks or credit unions that have few ATMs or branches so that it is hard to take out funds (although these days you can use electronic payments to pay bills, transfer to savings accounts etc. so this doesn't really impact me as I don't use much cash) but I think selecting a bank where "the rates may be lousy" is just plain stupid - I'm sure you can find an inconvient bank with lousy service and GOOD rates! ;)

4. Duck-the-Flyer: It's almost impossible to avoid getting bombarded with junk mail, so I've trained myself to look through them but never buy anything that I hadn't been already planning on (of course this means that you need to think about your needs and wants in a quiet corner - not when window shopping or reading through catalogues!). If you avoid advertising flyers completely you'll miss out on specials/discounts on the stuff you DID intend to buy - never buy at full price.

5. Cart-the-Check Around or Keep the Check in the Mail: Cash it and transfer the money immediately into your high-yield online savings account. You have to cash it eventually anyway (or lose the money entirely), so what's the point in missing out on interest in the meantime?

And as for her favorite trick:

Eat gourmet ice cream.

If you can only avoid over-spending when you feel "over-indulged" you need both overeaters anonymous and spenders anonymous!.

1. Hide-don't-Seek: I do this occasional by accident, and any "found" money goes into the kids money box as extra pocket money (My eldest son saves 100% of his pocketmoney anyhow, so it's a good deal). I would NOT do this scam intentionally as a) you risk losing notes if you just stuff bills into your pockets!, and b) how are you going to learn GOOD spending behaviour if you just avoid the effort?

2. Break the Bill: I do the exact opposite - I try to never take out cash (I use my day-to-day credit card for grocery shopping at the supermarket, doctors visits, bill payments etc. so I earn points - an extra 1% or so saving). When I have to take out cash (to make a payment that doesn't take credit cards, or charges a surcharge for payment by CC) I will then keep all the bills unbroken for as long as possible. I've trained myself hate having to hand over a nice whole bill and get a measly handful of "shrapnel" back. Also, having a random mix of small notes and many coins makes it hard to track exactly what you have spent each day and I find the money will magically disappear over a week if I don't keep an eagle-eye on it!

3. The Break-the-Bank trick: I've nothing against using banks or credit unions that have few ATMs or branches so that it is hard to take out funds (although these days you can use electronic payments to pay bills, transfer to savings accounts etc. so this doesn't really impact me as I don't use much cash) but I think selecting a bank where "the rates may be lousy" is just plain stupid - I'm sure you can find an inconvient bank with lousy service and GOOD rates! ;)

4. Duck-the-Flyer: It's almost impossible to avoid getting bombarded with junk mail, so I've trained myself to look through them but never buy anything that I hadn't been already planning on (of course this means that you need to think about your needs and wants in a quiet corner - not when window shopping or reading through catalogues!). If you avoid advertising flyers completely you'll miss out on specials/discounts on the stuff you DID intend to buy - never buy at full price.

5. Cart-the-Check Around or Keep the Check in the Mail: Cash it and transfer the money immediately into your high-yield online savings account. You have to cash it eventually anyway (or lose the money entirely), so what's the point in missing out on interest in the meantime?

And as for her favorite trick:

Eat gourmet ice cream.