How has Fine Art performed as an asset class compared to, say, stocks? The Mei/Moses Fine Art Index, the creation of NYU Stern School of Business finance professors Jiangping Mei and Michael Moses, tracks 9,000 pieces of art that were auctioned by Sotheby's and Christie's since 1950. The index measures the value of the art market by analyzing repeat sales of the different pieces of art that comprise the index. While it is generally considered a fair benchmark for art valuation, it excludes transaction fees, works that fail to sell at auction and certain styles of art, such as photography and prints.

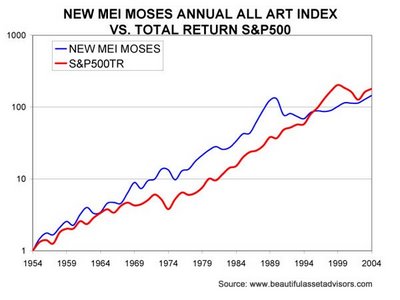

Over the last 50 years, stocks (as represented by the S&P 500) returned 10.9 percent annually, while the art index returned 10.5 percent per annum. As can be seen below, there is a low covariance between the Art Index and the S&P500 index:

One of the problems of consideraing Fine Art as an investment asset class is that in the art market, only about 30% to 50% of the works that change hands in any given year do so on the open market, at auction, where the public can see the prices. In the contemporary market, that figure plunges into the single digits. In addition, access to the market isn't always easy or cheap -- the supply of contemporary works is controlled by dealers, for instance, while hefty auction fees make it hard to compare the art market to any securities market. Therefore, the entry fee and management fees of any Art Fund are likely to be high - similar to that of Hedge Funds, but with performance that has historically been more in line with the stock market.

No comments:

Post a Comment