Summary of my 12% solution 'superhero' portfolio and 'moomoo' day trading account (and whatever miscellaneous trading I might do in future).

The "12% solution"" recommendation email from David Alan Carter for the end of December remained at 60% QQQ + 40% TLT. I hadn't needed to do any trades the previous few months, so I actually forgot about doing the 1 Dec trades to 'track' the "12% solution" portfolio as part of my 'superhero' app portfolio, only getting around to investing the USD$600 cash I had sitting in the app in QQQ units on 20 Dec. As I have other small investments in my superhero app, I've decided to not bother tracking the 12% solution trades in this account. I'll still monitor what the official "12% solution" asset allocation is meant to be each month, and compare how my total 'superhero' account balance in going using the "12% solution" performance as a 'benchmark'

Since the superhero app is the only account I currently use for trading in US shares, I want to add some more funds into the account at the start of Jan '24 and buy some BRKB, GOOG and AMZN shares are see how this portfolio goes during 2024. I'll probably add A$3K and buy A$1K worth of each. I'll do an overall portfolio holdings summary at the end of Jan and report the monthly valuations/movements and compare it to how the "12% solution" model portfolio does during 2024 and beyond.

My Moomoo trading account ended the month at $5,577.16 Total number of trades to date is 17 with a 53% Win:loss ratio. Overall my average gain on winning trades so far has been $87.95 (vs. target of $100 gain on winning trades), and the average loss of losing trades has been -$67.04 (vs/ target of -$50 loss limit on losing trades). As the market has been trending strongly upwards for the past few weeks, I did not close out the winning positions when the trade hit the target +$100 gain, but instead did a 'virtual trade' booking the trade as closed and recording a 'paper profit' and then recording a new open position with this new 'purchase price'. Basically as long as the up trend still seemed to be active, I just reset the stop-loss and take-profit alert levels to new values when the previous take-profit level was reached and booked this as a "win".

The position open at the end of the month was for 57 units of VAS 'bought' at a notional $93.13 with stops at $94.99 (gain) and $92.20 (loss). The closing price on Friday was $94.41 so is currently 'in the black'. I'll have to watch carefully at the open on Tuesday to see if the price suddenly gaps down after the holiday long weekend. The price had dipped a bit and the strong up trend appeared to have ended on Friday, after hitting a high of $94.74 on Thursday, so I am tempted to close out the position if it drops below $93.79 (the stop-loss price that would have been set according to my trading 'rules' if I had opened the position at $94.74 - sort of a manual trailing stop-loss tweak to my normal fixed price stops for each new trade.

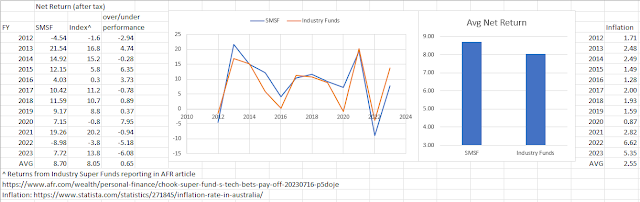

Looking at my overall trading account value vs the US S&P500 'benchmark' I realized that comparing the account value in A$ to the USS&P index most of the deviation was due to simply AUD:USD exchange rate fluctuations. So this month I have used the chart expressed in USD to compare my trading account value to the S&P500 'benchmark'. My 'outperformance' looks a lot less impressive when the exchange rate gains are stripped out of the comparison!

Update: I transferred A$4K to my trading account, then FX'd it (and A$0,12 cash I had sitting in the app) into USD resulting in USD$2,669.12 available to trade. The FX fee was $41.53, which offsets most of the benefit of getting 'free' trades for US shares using the app. I've placed orders to purchase equal $ amounts of GOOG, AMZN and BRK.B -- I'll find out when trading opens on Tuesday at what price the trades were executed.