My perennial self-promise has always been to loose weight and exercise more, and yet again this year I didn't manage to make any progress with either. So, as we were going to have a low-key Christmas anyway this year (as DS1 is away in Europe on a back-packing holiday before he starts uni at the end of February, and I won't be visiting my parents at the lake house until the New Year) I decided to eliminate the Christmas tradition of overeating and having lots of sweets, and instead get an early start on sticking to my diet plan. Nothing too onerous, just healthy breakfast, a modest lunch and healthy dinner, and a serious attempt to eliminate desserts and snacks from my diet. I also need to start tracking my daily step-count and make sure that I meet my target of at least 10,000 steps every day.

Aside from health and fitness, my others goals for next year are to complete the Diploma of Financial Planning course I'm doing via distance education, as well as a Six Sigma Green Belt certification I am doing at work. I've pretty much resigned myself to not re-enrolling in the MSc/PhD by research that I was doing part-time, as I can't see that I'll every get enough time for it while I'm working full-time, especially if I have any health issues such as during the past couple of years. I'm due to re-enrol by next July, so I'll wait and see if I my eczema improves significantly before then.

My other goal for 2018 is, of course, to keep my job as long as possible. Ideally I'd like to remain employed full-time for another 7+ years. But these days one could get retrenched at any time. And as DW has found out, it isn't easy to find a suitable full-time job when you're nearly sixty, despite the economy doing quite well at the moment.

Subscribe to Enough Wealth. Copyright 2006-2017

The ups and downs of trying to accumulate a seven-figure net worth on a five-figure salary, loose weight, get fit, do a post-grad course and launch a financial planning business - while working full-time.

Tuesday 26 December 2017

Thursday 14 December 2017

DS1 HSC results out

DS1 got his HSC marks via email last night, and sent them via IM to DW and myself (he is currently on a train between Vienna and Venice - halfway through his 10-week post-HSC European back-packing holiday). His results were close to what he expected, or slightly better:

Economics 93/100 band 6

Mathematics 90/100 band 6

Modern History 90/100 band 6

Software D&D 89/100 band 5

English Adv 87/100 band 5

English Ext1 43/50 band E3

Chemistry 83/100 band 5

Plugging these numbers into an ATAR calculator suggests he should get an ATAR of around 95.75, which should be plenty for him to get offered a place in his first choice uni course (Commerce/Computer Science double degree at UNSW), especially as UNSW offers 'bonus points' for getting top results in the top bands in English Advanced, English Extension 1, Mathematics and they also offer bonus points for having completed the Gold Duke of Edinburgh award.

His actual ATAR will be released tomorrow morning, and the first round of university offers will come out on December 21. I'm very happy with his HSC results, and delighted that he should be getting into his first preference uni course. Hopefully DS1 gets home safely from his European adventure at the end of January, and is keen to apply himself to his uni studies in 2018.

Subscribe to Enough Wealth. Copyright 2006-2017

Economics 93/100 band 6

Mathematics 90/100 band 6

Modern History 90/100 band 6

Software D&D 89/100 band 5

English Adv 87/100 band 5

English Ext1 43/50 band E3

Chemistry 83/100 band 5

Plugging these numbers into an ATAR calculator suggests he should get an ATAR of around 95.75, which should be plenty for him to get offered a place in his first choice uni course (Commerce/Computer Science double degree at UNSW), especially as UNSW offers 'bonus points' for getting top results in the top bands in English Advanced, English Extension 1, Mathematics and they also offer bonus points for having completed the Gold Duke of Edinburgh award.

His actual ATAR will be released tomorrow morning, and the first round of university offers will come out on December 21. I'm very happy with his HSC results, and delighted that he should be getting into his first preference uni course. Hopefully DS1 gets home safely from his European adventure at the end of January, and is keen to apply himself to his uni studies in 2018.

Subscribe to Enough Wealth. Copyright 2006-2017

Friday 1 December 2017

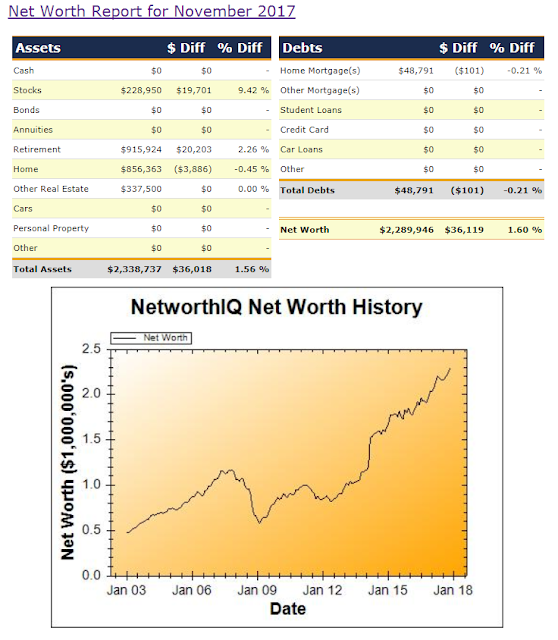

Net Worth: Nov 2017

DS1 has arrived in Europe for his 10-week post-HSC/pre-uni vacation. He had a couple of days stop-over in Singapore on the way, then spent a few days in Frankfurt before getting the ICE train to Berlin. He had a few days there (seems to be mostly visiting museums based on his IMs, but that might just be the sanitized version he is telling mum&dad). He left Berlin yesterday, travelling by train (he has a rail pass for ten days of train travel during his time in Europe) to Prague for the next stage of his journey. His HSC result and ATAR will arrive via SMS this month, and he'll find out if he gets offered a place in his first choice for uni (a Commerce/Computer Science double degree at UNSW).

DW is still looking for a new job, but is filling in her time doing some short courses and attending free investment seminars, playing table tennis etc. The sale of her investment unit 'settles' in a couple of weeks time, and she is planning on putting most of her $100K capital gain into her superannuation fund.

My net worth increased to a new high this month - due to the strength of the share market providing strong gains in both our superannuation investments and my geared stock portfolio. The valuation for our home dropped slightly (back to where it was two months ago), as the current weakness in the Sydney real estate market spreads to the more affluent suburbs of Sydney. The general consensus seems to be that the Sydney property market will decline by a modest amount during 2018 (maybe 5%-10% decline), but I'm not confident that we will see substantial gains in Sydney real estate during the coming decade, and we could see further falls if interest rates start to pick up.

Subscribe to Enough Wealth. Copyright 2006-2017

DW is still looking for a new job, but is filling in her time doing some short courses and attending free investment seminars, playing table tennis etc. The sale of her investment unit 'settles' in a couple of weeks time, and she is planning on putting most of her $100K capital gain into her superannuation fund.

My net worth increased to a new high this month - due to the strength of the share market providing strong gains in both our superannuation investments and my geared stock portfolio. The valuation for our home dropped slightly (back to where it was two months ago), as the current weakness in the Sydney real estate market spreads to the more affluent suburbs of Sydney. The general consensus seems to be that the Sydney property market will decline by a modest amount during 2018 (maybe 5%-10% decline), but I'm not confident that we will see substantial gains in Sydney real estate during the coming decade, and we could see further falls if interest rates start to pick up.

Subscribe to Enough Wealth. Copyright 2006-2017

Sunday 26 November 2017

Cheap Geiger Counters

I recently completed a free, online course of 'the threat of nuclear terrorism' (provided by Stanford University) and I've always had an interest in civil defense (I used to be a volunteer member of the NSW State Emergency Service back in the 80s, when, theoretically, the SES was responsible for civil defense - these days radiological emergencies are the responsibility of the police, with assistance from the health department). I also recently completed a couple of free, online courses on radiological emergency management available from FEMA (https://training.fema.gov/is/). While a radiological emergency has a very low probability of occurring in Australia, if one did occur it would be handy to have a Geiger counter available. Also, DS2 is going to enter the 'Young Scientist' competition next year, so I thought it would be a good time to buy one and let him use it as a cool science gadget for his science experiments ;)

I initially bought a cheap ~A$90 'GMV2' unit from China, via banggood.com. The unit arrived safely and seems to be working OK. It has four 'modes' - uSv/hr or CPM, with or without a 'beep' every time the GM tube generates a signal (generally from gamma rays, but there is also always some random system 'noise'). The built-in rechargeable battery lasts about an hour, so for measuring background radiation over longer periods it has to be left plugged into a USB power socket. I've run it for about 15 hours non-stop on several occasions and it worked fine. Unfortunately, it doesn't have an audio or data output port, so for data logging readings ever minute for the 12-15 hours I've had to leave it sitting in front of my laptop webcam and use a free image capture utility to record the display every minute. Manually entering the readings into excel is quite tedious.

Background radiation readings in our kitchen are around 0.08 uSv/hr on average, and outside on the patio the reading is around 0.04 uSv/hr (which seems about right, since the official background radiation reading at the ANSTO monitoring station at Engadine normally hovers around 35 nGy/hr = 0.035 uSv/hr). Readings indoors generally tend to be higher than outside, as radon gas decays into particles, which tend to accumulate indoors. Fortunately most of Australia doesn't have a problem with high levels of radon gas, unlike parts of the USA and Europe.

To test the meter response, I looked around the house for possible radiation sources, and managed to get about double the normal reading when the Geiger counter was placed on top of a granite slab (a discarded remnant from someone's kitchen renovation) that we use as a step in our garden. I also bought a packet of 'lite salt' at the supermarket, which has around 50% of the NCl replaced with KCl, and potassium naturally has around 0.0117% radioactive isotope K-40. Readings taken with the Geiger counter sitting on top of a zip-lock bag filled with the 'lite salt' were around 0.12-0.15 uSv/hr, so it provides only a slightly elevated reading above background.

I've also ordered a couple of potential, low-level radiation sources for DS2 to safely experiment with - a packet of ten TIG welding rods that contain 2% thorium for $10, and some gas lantern mantles that *might* also contain thorium (the ones now sold in Australia no longer contain thorium, so I bought some 'extra bright' ones from China for $2, that, hopefully, are old-school). I'll keep these locked away in the garage, as they need to be handled and stored safely.

I took the Geiger counter along on a little field trip to a site (Kellys bush) in Hunters Hill that was used as a radium refinery in the early 1900s, and used to have some mildly radioactive slag scattered around the area (the local council used to make road base!). There had been a very expensive clean up of the area done only a couple of years ago (the more 'radioactive' waste was taken to landfill to alleviate the local resident's concerns), but I was hoping that there might be a few left over samples still to be found. It turned out that the background radiation readings in the area weren't particularly high (~0.20 uSv/hr), which is lower than you find in high altitude locations (less atmospheric shielding from cosmic rays), or in areas with naturally high background radiation. But in one area the background reading was around 0.25 uSv/hr and I collected a couple of samples of black rocks (possibly slag). Down by the waterfront I found a fig tree with several likely-looking black rocks scattered around its roots, and the background reading there was between 0.50-0.70 uSv/hr. I collected the most 'radioactive' sample I could find, and later I checked the reading again (in an area where the background reading was only 0.07 uSv/hr) and found there is a spot on the sample surface where the Geiger counter reading reaches 0.74 uSv/hr. Still not dangerous (the EPA limit for public exposure is around 0.56 uSv/hr above background), and well under the 2.25 uSv/hr level for constant exposure that would be considered a significant risk. I'm still going to keep it locked away in the garage though!

For DS2's science experiment he is intending to try and measure the natural 'spike' in background radiation that sometimes occurs when it rains (radon decay products can be 'washed out' by rainfall if it hasn't rained for a week or so. This can elevate the background radiation level by up to 50% or so, which then drops down to normal levels after a couple of hours. The half-life of the radioactive isotopes, Pb-214 and Bi-214, is around half an hour).

Since the current Geiger counter can't easily be used for data logging, I decided to buy a second, more expensive (A$185) Geiger counter (model GMC-320plus) from Canada (via Ebay). This model isn't any more sensitive or accurate than the GMV2, but it has a longer battery life (~ 6 hours) and provides data output via USB cable, and free software to log the readings. This will make it a lot simpler for DS2 to setup the instrument and leave it running, and he can just check the plot after a heavy rain storm to see if there has been any 'spike' in the background radiation.

While neither of these instruments is suitable for use as a 'survey meter' in the event of a radiological emergency (they are too sensitive and would soon saturate), they could provide an initial warning of heightened radiation levels and the GMC-320plus can be set to sound an alarm when a predetermined threshold is exceeded. They could be used to monitor levels within a shelter (assuming the shelter had a high enough protection factor).

Subscribe to Enough Wealth. Copyright 2006-2017

I initially bought a cheap ~A$90 'GMV2' unit from China, via banggood.com. The unit arrived safely and seems to be working OK. It has four 'modes' - uSv/hr or CPM, with or without a 'beep' every time the GM tube generates a signal (generally from gamma rays, but there is also always some random system 'noise'). The built-in rechargeable battery lasts about an hour, so for measuring background radiation over longer periods it has to be left plugged into a USB power socket. I've run it for about 15 hours non-stop on several occasions and it worked fine. Unfortunately, it doesn't have an audio or data output port, so for data logging readings ever minute for the 12-15 hours I've had to leave it sitting in front of my laptop webcam and use a free image capture utility to record the display every minute. Manually entering the readings into excel is quite tedious.

Background radiation readings in our kitchen are around 0.08 uSv/hr on average, and outside on the patio the reading is around 0.04 uSv/hr (which seems about right, since the official background radiation reading at the ANSTO monitoring station at Engadine normally hovers around 35 nGy/hr = 0.035 uSv/hr). Readings indoors generally tend to be higher than outside, as radon gas decays into particles, which tend to accumulate indoors. Fortunately most of Australia doesn't have a problem with high levels of radon gas, unlike parts of the USA and Europe.

To test the meter response, I looked around the house for possible radiation sources, and managed to get about double the normal reading when the Geiger counter was placed on top of a granite slab (a discarded remnant from someone's kitchen renovation) that we use as a step in our garden. I also bought a packet of 'lite salt' at the supermarket, which has around 50% of the NCl replaced with KCl, and potassium naturally has around 0.0117% radioactive isotope K-40. Readings taken with the Geiger counter sitting on top of a zip-lock bag filled with the 'lite salt' were around 0.12-0.15 uSv/hr, so it provides only a slightly elevated reading above background.

I've also ordered a couple of potential, low-level radiation sources for DS2 to safely experiment with - a packet of ten TIG welding rods that contain 2% thorium for $10, and some gas lantern mantles that *might* also contain thorium (the ones now sold in Australia no longer contain thorium, so I bought some 'extra bright' ones from China for $2, that, hopefully, are old-school). I'll keep these locked away in the garage, as they need to be handled and stored safely.

I took the Geiger counter along on a little field trip to a site (Kellys bush) in Hunters Hill that was used as a radium refinery in the early 1900s, and used to have some mildly radioactive slag scattered around the area (the local council used to make road base!). There had been a very expensive clean up of the area done only a couple of years ago (the more 'radioactive' waste was taken to landfill to alleviate the local resident's concerns), but I was hoping that there might be a few left over samples still to be found. It turned out that the background radiation readings in the area weren't particularly high (~0.20 uSv/hr), which is lower than you find in high altitude locations (less atmospheric shielding from cosmic rays), or in areas with naturally high background radiation. But in one area the background reading was around 0.25 uSv/hr and I collected a couple of samples of black rocks (possibly slag). Down by the waterfront I found a fig tree with several likely-looking black rocks scattered around its roots, and the background reading there was between 0.50-0.70 uSv/hr. I collected the most 'radioactive' sample I could find, and later I checked the reading again (in an area where the background reading was only 0.07 uSv/hr) and found there is a spot on the sample surface where the Geiger counter reading reaches 0.74 uSv/hr. Still not dangerous (the EPA limit for public exposure is around 0.56 uSv/hr above background), and well under the 2.25 uSv/hr level for constant exposure that would be considered a significant risk. I'm still going to keep it locked away in the garage though!

For DS2's science experiment he is intending to try and measure the natural 'spike' in background radiation that sometimes occurs when it rains (radon decay products can be 'washed out' by rainfall if it hasn't rained for a week or so. This can elevate the background radiation level by up to 50% or so, which then drops down to normal levels after a couple of hours. The half-life of the radioactive isotopes, Pb-214 and Bi-214, is around half an hour).

Since the current Geiger counter can't easily be used for data logging, I decided to buy a second, more expensive (A$185) Geiger counter (model GMC-320plus) from Canada (via Ebay). This model isn't any more sensitive or accurate than the GMV2, but it has a longer battery life (~ 6 hours) and provides data output via USB cable, and free software to log the readings. This will make it a lot simpler for DS2 to setup the instrument and leave it running, and he can just check the plot after a heavy rain storm to see if there has been any 'spike' in the background radiation.

While neither of these instruments is suitable for use as a 'survey meter' in the event of a radiological emergency (they are too sensitive and would soon saturate), they could provide an initial warning of heightened radiation levels and the GMC-320plus can be set to sound an alarm when a predetermined threshold is exceeded. They could be used to monitor levels within a shelter (assuming the shelter had a high enough protection factor).

Subscribe to Enough Wealth. Copyright 2006-2017

Wednesday 1 November 2017

Net Worth: Oct 2017

My foot is still recovering from a bad sprain (I might have fractured a toe bone, but I haven't bothered getting an x-ray). DW is still looking for work. DS1 in the middle of his HSC exams and will be flying off to Europe for a back-packing/youth hostel holiday later this month.

My net worth reached a new 'all time high', mostly due to the strong run-up in the local stock market last month helping my geared share portfolio and our SMSF investments. The valuation for our home also increased slightly (based on suburb sales data). But the Sydney real estate market is definitely 'off the boil' with some weakness in auction clearance rates, a slight decline in the median home price for Sydney, and a 'glut' in new units coming on to the market. If the sale of DW's investment unit 'settles' next month she will be relieved, as it definitely looks like the rental and sales market for new units is getting weaker.

Subscribe to Enough Wealth. Copyright 2006-2017

My net worth reached a new 'all time high', mostly due to the strong run-up in the local stock market last month helping my geared share portfolio and our SMSF investments. The valuation for our home also increased slightly (based on suburb sales data). But the Sydney real estate market is definitely 'off the boil' with some weakness in auction clearance rates, a slight decline in the median home price for Sydney, and a 'glut' in new units coming on to the market. If the sale of DW's investment unit 'settles' next month she will be relieved, as it definitely looks like the rental and sales market for new units is getting weaker.

Subscribe to Enough Wealth. Copyright 2006-2017

Monday 9 October 2017

Net Worth: Sep 2017

I was too busy last month to update my net worth spreadsheet or post a blog entry. Busy at work, and also busy getting my second eye operation done. I was up at my 'hobby farm' last week (didn't get much done while there, as I'd hurt my foot falling off our patio the week before!), so had a relaxing time and only just got around to doing a belated 'monthly' net worth calculation and updated networthiq with the figures.

The stock market improved during the past two months, so my geared share investment portfolio and retirement savings (SMSF) balance both improved during August and September. The estimated valuation for our house also continued to rise in August, but showed only a slight gain in September. I won't be surprised to see Sydney real estate prices stagnate or fall slightly over the next couple of years (especially home units, of which there seems to be a 'glut' developing).

DW is still looking for work, and so she decided to sell her brand new apartment after not having being able to find a tenant during the month immediately following 'settlement'. Fortunately, soon after listing the unit for sale, there was one seriously interested buyer, who has now paid a 5% deposit and exchanged contracts (but also asked for a 12-week settlement period - the normal settlement period is 6 weeks). Hopefully the sale goes through without any problem. If so, DW will have realized a profit of around $100K, which she intends to contibute to her superannuation savings. That way, even if she only has a series of casual jobs for the next ten years (until 'retirement age') she will have already accumulated enough to self-fund her retirement (assuming future stock market returns meet our expectations).

Subscribe to Enough Wealth. Copyright 2006-2017

The stock market improved during the past two months, so my geared share investment portfolio and retirement savings (SMSF) balance both improved during August and September. The estimated valuation for our house also continued to rise in August, but showed only a slight gain in September. I won't be surprised to see Sydney real estate prices stagnate or fall slightly over the next couple of years (especially home units, of which there seems to be a 'glut' developing).

DW is still looking for work, and so she decided to sell her brand new apartment after not having being able to find a tenant during the month immediately following 'settlement'. Fortunately, soon after listing the unit for sale, there was one seriously interested buyer, who has now paid a 5% deposit and exchanged contracts (but also asked for a 12-week settlement period - the normal settlement period is 6 weeks). Hopefully the sale goes through without any problem. If so, DW will have realized a profit of around $100K, which she intends to contibute to her superannuation savings. That way, even if she only has a series of casual jobs for the next ten years (until 'retirement age') she will have already accumulated enough to self-fund her retirement (assuming future stock market returns meet our expectations).

Subscribe to Enough Wealth. Copyright 2006-2017

Thursday 10 August 2017

DW employed again, again

Fortunately, although her last 'new job' lasted little more than a week, DW had another job interview later the same week, and was offered the position (which she started this week). The new job is less stressful (there are new systems to learn, but at least the business is a successful going concern rather than a shambolic start-up) and actually pays $5K pa more. So far DW seems to be settling in to the new job quite happily, and gets along with all the staff. On the positive side, the company location is slightly more convenient (about the same distance bus trip, but against the peak hour traffic flow, so a quicker trip - about 20 minutes) and it is only a five minute walk from the office to a nice shopping mall for lunch-time outings.

On the down-side, the position is only guaranteed to stay full-time for three months while an existing staff member is away on maternity leave. If the staff member chooses to not return to work (apparently she lives about 1.5 hours commute away, which may not be practical with a young child) DW's position will remain full-time, but otherwise her hours will be reduced to part-time (at least for a while). As DW's last permanent job had been part-time since DS2 was born a decade ago, she would quite like to work part-time. However, having just drawn down almost half a million loan to 'settle' the purchase of the off-the-plan investment unit she bought last year, it would be better if she worked full-time. A full-time job would allow her to pay off about $20K of the loan principal each year, plus she'd be getting more money contributed into her superannuation.

We'll see how this job works out in the long term...

Subscribe to Enough Wealth. Copyright 2006-2017

On the down-side, the position is only guaranteed to stay full-time for three months while an existing staff member is away on maternity leave. If the staff member chooses to not return to work (apparently she lives about 1.5 hours commute away, which may not be practical with a young child) DW's position will remain full-time, but otherwise her hours will be reduced to part-time (at least for a while). As DW's last permanent job had been part-time since DS2 was born a decade ago, she would quite like to work part-time. However, having just drawn down almost half a million loan to 'settle' the purchase of the off-the-plan investment unit she bought last year, it would be better if she worked full-time. A full-time job would allow her to pay off about $20K of the loan principal each year, plus she'd be getting more money contributed into her superannuation.

We'll see how this job works out in the long term...

Subscribe to Enough Wealth. Copyright 2006-2017

Thursday 3 August 2017

Cataract Surgery - one down, one to go

At the start of last year I noticed I was tending to polish my glasses a lot, as the right hand lens often seemed to be a bit smudged. So I wasn't particularly surprised when the optometrist confirmed during an eye test last March that I was developing a cataract in my right eye*. I'd also noticed an obstruction when viewing pistol shooting targets in bright light when the aperture of my shooting glasses was reduced to less than a mm. It looked a bit like a piece of fluff or organic growth in the middle of the shooting glasses aperture...

Anyhow, I put up with my right eye's vision getting progressively less clear (especially in bright light) until March this year, when I decided to get a referral from my GP to an opthamologist. In the initial check-up last month it was confirmed that I had a pretty advanced cataract in my right eye, and there were early signs of it also developing in my left eye (but so far not affecting the vision noticeably). So I decided to go ahead and get cataract surgery done on both eyes (the operation replaces the lens inside each eye, so will correct my distance vision (I currently need bifocals as I've always been short-sighted, and in recent years also had difficulty focussing on computer screens - my natural range of clear focus was restricted to about 8cm-30cm!).

I had the operation on my right eye last Monday afternoon, and was back at work on Tuesday and had a check-up on Tuesday afternoon. The results were pretty amazing - my distance vision in my right eye is now very bright and clear (better than in my left eye wearing glasses) and is pretty good down to about 2m away. Closer than that it is still in sharp focus, but unfortunately it is blurred with multiple images at close range. Hopefully that will be correctly by getting new 'reading glasses' once my left eye operation has been done in a couple of week's time.

The operation on my right eye cost about $2400, with a refund from medicare of almost $800 leaving me $1600 'out of pocket'. The day surgery private hospital fee also cost around $2000, but was fully refunded by the private health insurance provided by my employer. I expect I'll also get a bill of around $700 from the anaesthetist, but will get some of that refunded by the private health cover and medicare.

The operation on my left eye later this month will cost similar amounts, although I'll get a larger proportion of the $2400 surgeon bill refunded by medicare (due to reaching some 'threshold' amount of 'out of pocket' annual expenses).

So, the whole process has been quite successful (so far), rather expensive (even with full private health cover) and fairly painless. I could have opted to get the surgery done in a 'public hospital' under medicare, but there still would have been some 'gap' payments due, a 6-12 month waiting list for this 'elective' surgery, and no choice of surgeon. And of course in the public hospital system there are always a chance that your operation will be part of the training of a new surgeon, which increases the chances of a less than ideal outcome. Overall, when it comes to having knives inserted into my eyes, I'm happy to spend a bit more in order to maximize the probability of a good outcome!

* I'm a bit young to be getting cataracts, but a lifetime of topical steroid medications for severe eczema was a known risk factor.

Subscribe to Enough Wealth. Copyright 2006-2017

Anyhow, I put up with my right eye's vision getting progressively less clear (especially in bright light) until March this year, when I decided to get a referral from my GP to an opthamologist. In the initial check-up last month it was confirmed that I had a pretty advanced cataract in my right eye, and there were early signs of it also developing in my left eye (but so far not affecting the vision noticeably). So I decided to go ahead and get cataract surgery done on both eyes (the operation replaces the lens inside each eye, so will correct my distance vision (I currently need bifocals as I've always been short-sighted, and in recent years also had difficulty focussing on computer screens - my natural range of clear focus was restricted to about 8cm-30cm!).

I had the operation on my right eye last Monday afternoon, and was back at work on Tuesday and had a check-up on Tuesday afternoon. The results were pretty amazing - my distance vision in my right eye is now very bright and clear (better than in my left eye wearing glasses) and is pretty good down to about 2m away. Closer than that it is still in sharp focus, but unfortunately it is blurred with multiple images at close range. Hopefully that will be correctly by getting new 'reading glasses' once my left eye operation has been done in a couple of week's time.

The operation on my right eye cost about $2400, with a refund from medicare of almost $800 leaving me $1600 'out of pocket'. The day surgery private hospital fee also cost around $2000, but was fully refunded by the private health insurance provided by my employer. I expect I'll also get a bill of around $700 from the anaesthetist, but will get some of that refunded by the private health cover and medicare.

The operation on my left eye later this month will cost similar amounts, although I'll get a larger proportion of the $2400 surgeon bill refunded by medicare (due to reaching some 'threshold' amount of 'out of pocket' annual expenses).

So, the whole process has been quite successful (so far), rather expensive (even with full private health cover) and fairly painless. I could have opted to get the surgery done in a 'public hospital' under medicare, but there still would have been some 'gap' payments due, a 6-12 month waiting list for this 'elective' surgery, and no choice of surgeon. And of course in the public hospital system there are always a chance that your operation will be part of the training of a new surgeon, which increases the chances of a less than ideal outcome. Overall, when it comes to having knives inserted into my eyes, I'm happy to spend a bit more in order to maximize the probability of a good outcome!

* I'm a bit young to be getting cataracts, but a lifetime of topical steroid medications for severe eczema was a known risk factor.

Subscribe to Enough Wealth. Copyright 2006-2017

Wednesday 2 August 2017

Net Worth: Jul 2017

It turned out that the large dividend paid into our Vanguard Fund last month was offset by a corresponding reduction in the unit valuation, which hadn't been updated at the time I posted last month's net worth report. So I've corrected the value in networthiq for last month, and this month's figures (below) show that actual monthly change compared to these corrected figures.

After making the correction, it turns out that my NW decreased slightly last month, and again this month, mostly due to weakness in the local and international stock markets. The overall trend in my NW is satisfactory over the past 15 years, although the losses caused by the GFC and EFC basically wiped out the increment in my NW that came from my 'early inheritance' of the lake house from my parents. Due to the use of gearing in my stock portfolio (and letting the index 'put' options I had in place Mar-Dec 2007 lapse just prior to the onset of the GFC), I had to sell off a considerable portion of my geared portfolio in Mar 2008 to avoid getting a 'margin call', which 'locked in' the losses caused by the GFC. As I was a bit more conservative with the level of gearing used in my stock portfolio post-GFC, I didn't recover all my losses as the stock market recovered.

DW is again looking for a job - her latest position lasted just over a week before her 'boss' decided it wasn't working out as he'd expected. After pointing out they hadn't even provided her with a phone or computer (expecting her to "make do" with her own mobile phone and her personal laptop) and that her boss had given unclear instructions (conveyed via mobile phone when she was having her lunch break) and was never in the office to clarify what was required, the directors offered to give her a bit longer to 'settle in' to the role. But they also pointed out that the chaotic office situation would stay the same, So DW decided to call it quits and look for a less stressful/more enjoyable position. She had another interview yesterday, so I'm sure something suitable will turn up eventually.

Subscribe to Enough Wealth. Copyright 2006-2017

After making the correction, it turns out that my NW decreased slightly last month, and again this month, mostly due to weakness in the local and international stock markets. The overall trend in my NW is satisfactory over the past 15 years, although the losses caused by the GFC and EFC basically wiped out the increment in my NW that came from my 'early inheritance' of the lake house from my parents. Due to the use of gearing in my stock portfolio (and letting the index 'put' options I had in place Mar-Dec 2007 lapse just prior to the onset of the GFC), I had to sell off a considerable portion of my geared portfolio in Mar 2008 to avoid getting a 'margin call', which 'locked in' the losses caused by the GFC. As I was a bit more conservative with the level of gearing used in my stock portfolio post-GFC, I didn't recover all my losses as the stock market recovered.

DW is again looking for a job - her latest position lasted just over a week before her 'boss' decided it wasn't working out as he'd expected. After pointing out they hadn't even provided her with a phone or computer (expecting her to "make do" with her own mobile phone and her personal laptop) and that her boss had given unclear instructions (conveyed via mobile phone when she was having her lunch break) and was never in the office to clarify what was required, the directors offered to give her a bit longer to 'settle in' to the role. But they also pointed out that the chaotic office situation would stay the same, So DW decided to call it quits and look for a less stressful/more enjoyable position. She had another interview yesterday, so I'm sure something suitable will turn up eventually.

Subscribe to Enough Wealth. Copyright 2006-2017

Tuesday 25 July 2017

Diet & Exercise update - Week 29

Diet & Exercise update - Week 29

Last week went OK Mon-Fri (Avg 2,333 kcals/day, and walking 12,547 step/day on average), but I then spent the weekend watching seasons 1-3 of 'Fear the Walking Dead' and eating a lot of confectionary. Quite enjoyable, but not a good way to loose weight or get fit! I averaged 4,558 kcals/day over the weekend, and only averaged 7,352 steps/day. I'm back on track this week, but will have to make sure I stick to my diet plan next weekend and do enough walking.

DS1 did a bit of archery in our back yard on Saturday. I collected my new bow from the post office on Saturday morning, but didn't get to shoot it yet. It looks quite good quality for $70, and the draw weight seems fine (and I have no problem using a left-hand bow), but it didn't come with any assembly instructions so I spent a bit of time scratching my head trying to work out exactly how the sight and arrow rest attach. There are some videos on the store's website, but they are for different models and accessories. My best guide is the single image their website has of the assembled bow. I'll also need to get some marine plywood or a block of high density foam to put behind our target before starting to practice.

DW quit her new job today - it had been a hectic first week, staying late and working at home in the evenings to try to get things done, and too stressful. She's had plenty of experience as an office worker, but this was her first attempt at being an 'office manager' and was basically left to sink-or-swim by her busy boss. While she could have probably stuck it out and learned on the job, I don't think it's the sort of thing she would enjoy in the long term, although she was interested in this type of business operation. So, back to the job hunt she goes...

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

Week 24 32.8 64.5 17.7 116.2 2,808 105.2 7,258

Week 25 20.6 61.3 24.5 63.7 1,894 103.0 8,406

Week 26 43.7 64.4 16.6 113.7 2,475 101.5 10,257

Week 27 43.2 61.8 22.1 118.7 3,150 102.1 7,715

Week 28 50.6 63.4 19.2 147.7 3,536 102.2 8,099

Week 29 33.4 64.3 17.9 117.0 2,974 101.9 11,062

Subscribe to Enough Wealth. Copyright 2006-2017

Last week went OK Mon-Fri (Avg 2,333 kcals/day, and walking 12,547 step/day on average), but I then spent the weekend watching seasons 1-3 of 'Fear the Walking Dead' and eating a lot of confectionary. Quite enjoyable, but not a good way to loose weight or get fit! I averaged 4,558 kcals/day over the weekend, and only averaged 7,352 steps/day. I'm back on track this week, but will have to make sure I stick to my diet plan next weekend and do enough walking.

DS1 did a bit of archery in our back yard on Saturday. I collected my new bow from the post office on Saturday morning, but didn't get to shoot it yet. It looks quite good quality for $70, and the draw weight seems fine (and I have no problem using a left-hand bow), but it didn't come with any assembly instructions so I spent a bit of time scratching my head trying to work out exactly how the sight and arrow rest attach. There are some videos on the store's website, but they are for different models and accessories. My best guide is the single image their website has of the assembled bow. I'll also need to get some marine plywood or a block of high density foam to put behind our target before starting to practice.

DW quit her new job today - it had been a hectic first week, staying late and working at home in the evenings to try to get things done, and too stressful. She's had plenty of experience as an office worker, but this was her first attempt at being an 'office manager' and was basically left to sink-or-swim by her busy boss. While she could have probably stuck it out and learned on the job, I don't think it's the sort of thing she would enjoy in the long term, although she was interested in this type of business operation. So, back to the job hunt she goes...

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

Week 24 32.8 64.5 17.7 116.2 2,808 105.2 7,258

Week 25 20.6 61.3 24.5 63.7 1,894 103.0 8,406

Week 26 43.7 64.4 16.6 113.7 2,475 101.5 10,257

Week 27 43.2 61.8 22.1 118.7 3,150 102.1 7,715

Week 28 50.6 63.4 19.2 147.7 3,536 102.2 8,099

Week 29 33.4 64.3 17.9 117.0 2,974 101.9 11,062

Subscribe to Enough Wealth. Copyright 2006-2017

Thursday 20 July 2017

Diet & Exercise update - Week 28

Well, taking Friday off work last week to drive up to the lake house to collect DS2 at the end of the school holidays (he was staying with my parents for two weeks) meant that I had a long weekend of fattening home-cooked meals which blew my diet plan yet again. My avg daily kcals over the three days was over 4,000 kcals!. However, even before my weekend trip I'd been struggling to avoid snacking in the evenings, and my average kcals for the rest of last week was over 3,000 kclas/day. My maintenance kcals/day is around 2,800 (as long as I do my 12,000+ steps walking), and my 'standard' diet plan adds up to around 1,800-2,000 kcals/day.

This week has got off to a better start (averaging around 2,200 kcals/day so far). I've managed to (mostly) avoid snacking and stick to my diet plan. I've exceeded my 12,000 step target for walking each day, and I've even done a bit of exercise on the elliptical trainer while watching TV after dinner (it's already included in my step count total, but provides a bit more aerobic exercise than simply walking).

While DS2 was at the farm he enjoyed doing some archery with the cheap ($60) compound bow I'd bought him. As he wasn't too keen on letting me 'have a turn', I decided to also buy myself a similar (ie. cheap) compound bow so we can do some archery practice together in the back yard when the weather is suitable.

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

Week 24 32.8 64.5 17.7 116.2 2,808 105.2 7,258

Week 25 20.6 61.3 24.5 63.7 1,894 103.0 8,406

Week 26 43.7 64.4 16.6 113.7 2,475 101.5 10,257

Week 27 43.2 61.8 22.1 118.7 3,150 102.1 7,715

Week 28 50.6 63.4 19.2 147.7 3,536 102.2 8,099

Subscribe to Enough Wealth. Copyright 2006-2017

This week has got off to a better start (averaging around 2,200 kcals/day so far). I've managed to (mostly) avoid snacking and stick to my diet plan. I've exceeded my 12,000 step target for walking each day, and I've even done a bit of exercise on the elliptical trainer while watching TV after dinner (it's already included in my step count total, but provides a bit more aerobic exercise than simply walking).

While DS2 was at the farm he enjoyed doing some archery with the cheap ($60) compound bow I'd bought him. As he wasn't too keen on letting me 'have a turn', I decided to also buy myself a similar (ie. cheap) compound bow so we can do some archery practice together in the back yard when the weather is suitable.

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

Week 24 32.8 64.5 17.7 116.2 2,808 105.2 7,258

Week 25 20.6 61.3 24.5 63.7 1,894 103.0 8,406

Week 26 43.7 64.4 16.6 113.7 2,475 101.5 10,257

Week 27 43.2 61.8 22.1 118.7 3,150 102.1 7,715

Week 28 50.6 63.4 19.2 147.7 3,536 102.2 8,099

Subscribe to Enough Wealth. Copyright 2006-2017

Wednesday 19 July 2017

DW employed again

Well, it took a while, but DW was finally offered a full-time position last Friday and started her new job on Monday. Apparently there were 100 applicants for this position, with 25 people selected for an interview, and at the end of her interview last Thursday she was told she was on the 'short list' of three applicants being considered.

The position is 'Office Manager' for a start-up financial planning business being created by an existing residential property sales firm (it has an existing client list that are likely to require financial planning services, so has a good chance of being successful). Her starting salary ($55K+SGL) isn't too bad - although the hourly rate is only around 85% of her previous position, the fact that it is a full-time position means that overall she will actually be earning around 40% more than when she was working three days/week as a permanent part-time employee for the past decade or so. And if the business does well she may get an increase once she has been in the role for a year or so.

The company is located in a nearby suburb, which is ideal. I drive that way every morning on the way to drop DS2 off at school on my way to work, so it is very convenient for DW to also get a lift in the mornings, and she only has to catch a short bus trip home after work. It is also located close to the train station DS2 gets off at to catch the bus home after school, so she may meet him there occasionally.

Working full-time will mean that DW can accumulate some additional superannuation savings before we reach retirement age. And she'll be able to fund the shortfall in rental income vs. the cost of her new investment unit, and get some tax benefit from having a negatively geared property investment.

Hopefully she enjoys this new job, and it lasts.

Subscribe to Enough Wealth. Copyright 2006-2017

The position is 'Office Manager' for a start-up financial planning business being created by an existing residential property sales firm (it has an existing client list that are likely to require financial planning services, so has a good chance of being successful). Her starting salary ($55K+SGL) isn't too bad - although the hourly rate is only around 85% of her previous position, the fact that it is a full-time position means that overall she will actually be earning around 40% more than when she was working three days/week as a permanent part-time employee for the past decade or so. And if the business does well she may get an increase once she has been in the role for a year or so.

The company is located in a nearby suburb, which is ideal. I drive that way every morning on the way to drop DS2 off at school on my way to work, so it is very convenient for DW to also get a lift in the mornings, and she only has to catch a short bus trip home after work. It is also located close to the train station DS2 gets off at to catch the bus home after school, so she may meet him there occasionally.

Working full-time will mean that DW can accumulate some additional superannuation savings before we reach retirement age. And she'll be able to fund the shortfall in rental income vs. the cost of her new investment unit, and get some tax benefit from having a negatively geared property investment.

Hopefully she enjoys this new job, and it lasts.

Subscribe to Enough Wealth. Copyright 2006-2017

Wednesday 12 July 2017

Aircon con (or just a rip-off?)

When we bought our house about twelve years ago, it came with a renovated kitchen and bathroom and Daikin reverse cycle split system airconditioner installed in the family room. I was flabbergasted by the price the receipt showed that previous owner had paid for the aircon unit (around $6500).

So, when the air con started playing up last summer (it would shut itself down after running for about 5 minutes, and after restarting it about 12 times it would fault out and refuse to restart unless the mains power was shut down to reset the system) I suspected it might be quite expensive to have it repaired. The error message indicated that there was an over-voltage fault, which suggested something wasn't running properly in the exterior fan unit. At the time I tried getting the company that had originally supplied and installed the unit to come for a service call, but during summer the waiting time for a booking was several months! So I waited until mid-winter to make a booking...

The initial service call cost almost $300 (I had to agree to the basic call-out fee and provide my CC details before they would make the booking), and revealed that the fan unit had failed and would need replacing. Apparently the control unit (PCB) was also damaged and would need replacing. At the time the service guy indicated that this would cost a few hundred dollars, and he said that a quote for the repair would be sent through. I wasn't delighted by the prospect of having to pay over $500 to repair a 15-year-old unit with parts that would 'probably' last five or so years, especially since it was quite likely that other pieces of the unit may fail due to age.

Well, the quote arrived yesterday, and it was a whopper! $500+ for installation (apparently it will take their 'professional' repairer 3-4 hours to simply replace a fan unit and a PCB board!), around $300 for the fan unit, and around $600 for a replacement 'motherboard'. All up, around $1400 on top of the $300 already paid to identify the fault. The icing on the cake was that the quote stated that there may be other faults that won't become apparent until the fan and PCB have been replaced and the unit tested... so basically we could pay $1700 and still not have a working air conditioner!

Considering that Aldi often sells split system air conditioner units for only $499 (a 6.4kW system), I've decided to not proceed with repairs to the Daikin system. Instead, I'll shop around for a decent, bargain-priced unit, and gets some quotes for installation. Hopefully I can get a brand new system installed for less than the cost of getting our old system (maybe) repaired.

Subscribe to Enough Wealth. Copyright 2006-2017

So, when the air con started playing up last summer (it would shut itself down after running for about 5 minutes, and after restarting it about 12 times it would fault out and refuse to restart unless the mains power was shut down to reset the system) I suspected it might be quite expensive to have it repaired. The error message indicated that there was an over-voltage fault, which suggested something wasn't running properly in the exterior fan unit. At the time I tried getting the company that had originally supplied and installed the unit to come for a service call, but during summer the waiting time for a booking was several months! So I waited until mid-winter to make a booking...

The initial service call cost almost $300 (I had to agree to the basic call-out fee and provide my CC details before they would make the booking), and revealed that the fan unit had failed and would need replacing. Apparently the control unit (PCB) was also damaged and would need replacing. At the time the service guy indicated that this would cost a few hundred dollars, and he said that a quote for the repair would be sent through. I wasn't delighted by the prospect of having to pay over $500 to repair a 15-year-old unit with parts that would 'probably' last five or so years, especially since it was quite likely that other pieces of the unit may fail due to age.

Well, the quote arrived yesterday, and it was a whopper! $500+ for installation (apparently it will take their 'professional' repairer 3-4 hours to simply replace a fan unit and a PCB board!), around $300 for the fan unit, and around $600 for a replacement 'motherboard'. All up, around $1400 on top of the $300 already paid to identify the fault. The icing on the cake was that the quote stated that there may be other faults that won't become apparent until the fan and PCB have been replaced and the unit tested... so basically we could pay $1700 and still not have a working air conditioner!

Considering that Aldi often sells split system air conditioner units for only $499 (a 6.4kW system), I've decided to not proceed with repairs to the Daikin system. Instead, I'll shop around for a decent, bargain-priced unit, and gets some quotes for installation. Hopefully I can get a brand new system installed for less than the cost of getting our old system (maybe) repaired.

Subscribe to Enough Wealth. Copyright 2006-2017

Monday 10 July 2017

Diet & Exercise update - Week 27

Last week was fairly unsatisfactory, diet-wise. I didn't walk enough on four out of seven days last week, and I only had two days where my caloric intake was below maintenance level, and three days above. Overall, my average daily caloric intake for the week was above my maintenance level, so it wasn't a surprise that my average daily weight increased slightly.

I saw my immunologist last Friday for a check-up. My blood test results show that the gluten-free diet has brought my Coeliac disease under control. But my eczema hasn't been improving, so we decided to change medication. I also saw an opthamologist later the same day, and it was confirmed that I have developed a fairly advanced cataract in my right eye, so I'll be having eye surgery later this month on one eye. As the procedure will improve my short-sightedness, I'll then also have my other eye operation done a few weeks later (having one eye corrected to achieve good distance vision, and leaving the other eye needing strong corrective lenses doesn't work very well). Having the day surgeries done as a 'private' patient, after medicare and private insurance refunds, I will be 'out-of-pocket' by about $2,000 per eye. Hopefully all goes well.

Aldi was selling some Elliptical Trainers for $299 so I bought one and DS1 helped me lug it to the car (~45kg). DS1 took about three hours to assemble it, only needing to ask me for help a couple of times. It seems to be working perfectly well so far (the reviews online are fairly mixed, with the quality and reliability seeming to vary a lot between units), and we've set it up in the lounge so I can do a bit of exercise while watching TV in the evenings. It is fairly easy to use (in default mode - I haven't yet tried the myriad training 'modes' available on the computer), although the foot rests are slightly further apart than I'd like. To use it I have to shift my weight from side-to-side and it is more akin to stair climbing than walking. The natural cycle time (for me) is around 60 steps/min, which is quite a lot slower than my normal walking pace (~100 steps/min), so although using the eliptical training registers as 'steps' on my step counter, it will only contribute a small amount towards my daily goal of 12,000+ steps. My thighs started to 'feel it' after only five minutes of use, so I'll start off with a few short sessions every evening, and gradually build up to longer periods of continuous use. It is probably a good way to get into condition for doing some cross-country skiing! It is fairly low impact, so it is better for my knees (and the TV!) than jogging on the spot or skipping.

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

Week 24 32.8 64.5 17.7 116.2 2,808 105.2 7,258

Week 25 20.6 61.3 24.5 63.7 1,894 103.0 8,406

Week 26 43.7 64.4 16.6 113.7 2,475 101.5 10,257

Week 27 43.2 61.8 22.1 118.7 3,150 102.1 7,715

Subscribe to Enough Wealth. Copyright 2006-2017

I saw my immunologist last Friday for a check-up. My blood test results show that the gluten-free diet has brought my Coeliac disease under control. But my eczema hasn't been improving, so we decided to change medication. I also saw an opthamologist later the same day, and it was confirmed that I have developed a fairly advanced cataract in my right eye, so I'll be having eye surgery later this month on one eye. As the procedure will improve my short-sightedness, I'll then also have my other eye operation done a few weeks later (having one eye corrected to achieve good distance vision, and leaving the other eye needing strong corrective lenses doesn't work very well). Having the day surgeries done as a 'private' patient, after medicare and private insurance refunds, I will be 'out-of-pocket' by about $2,000 per eye. Hopefully all goes well.

Aldi was selling some Elliptical Trainers for $299 so I bought one and DS1 helped me lug it to the car (~45kg). DS1 took about three hours to assemble it, only needing to ask me for help a couple of times. It seems to be working perfectly well so far (the reviews online are fairly mixed, with the quality and reliability seeming to vary a lot between units), and we've set it up in the lounge so I can do a bit of exercise while watching TV in the evenings. It is fairly easy to use (in default mode - I haven't yet tried the myriad training 'modes' available on the computer), although the foot rests are slightly further apart than I'd like. To use it I have to shift my weight from side-to-side and it is more akin to stair climbing than walking. The natural cycle time (for me) is around 60 steps/min, which is quite a lot slower than my normal walking pace (~100 steps/min), so although using the eliptical training registers as 'steps' on my step counter, it will only contribute a small amount towards my daily goal of 12,000+ steps. My thighs started to 'feel it' after only five minutes of use, so I'll start off with a few short sessions every evening, and gradually build up to longer periods of continuous use. It is probably a good way to get into condition for doing some cross-country skiing! It is fairly low impact, so it is better for my knees (and the TV!) than jogging on the spot or skipping.

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

Week 24 32.8 64.5 17.7 116.2 2,808 105.2 7,258

Week 25 20.6 61.3 24.5 63.7 1,894 103.0 8,406

Week 26 43.7 64.4 16.6 113.7 2,475 101.5 10,257

Week 27 43.2 61.8 22.1 118.7 3,150 102.1 7,715

Subscribe to Enough Wealth. Copyright 2006-2017

Thursday 6 July 2017

Diet & Exercise update - Week 26

Last week saw continued progress with my weight loss, although I did overeat on the weekend (while visiting my parents at the lake house). I've been achieving my stepcount (walking) target most days (12,000 steps/day), but haven't yet restarted doing daily 5BX exercise sessions in the evenings. I've also been snacking a little bit in the evenings since getting back from the lake house, so I need to clamp down on that asap.

I got some blood test results back from my GP. My Cholesterol and Triglyceride levels have actually improved slightly (within the 'normal' range), although my HDL:total cholesterol ratio could still be improved, and my LDL ('bad' cholesterol) levels should also be reduced further (this should occur naturally if I loose weight and exercise more...). I should probably start having some tinned tuna in addition to my tin of baked beans for lunch at work.

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

Week 20 38.8 63.6 21.4 118.9 3,371 104.6 6,563

Week 21 33.3 62.9 21.0 105.7 3,056 104.4 6,957

Week 22 20.4 61.6 22.4 123.8 3,390 104.9 8,962

Week 23 32.2 69.6 13.3 106.7 2,840 104.5 6,471

Week 24 32.8 64.5 17.7 116.2 2,808 105.2 7,258

Week 25 20.6 61.3 24.5 63.7 1,894 103.0 8,406

Week 26 43.7 64.4 16.6 113.7 2,475 101.5 10,257

Subscribe to Enough Wealth. Copyright 2006-2017

I got some blood test results back from my GP. My Cholesterol and Triglyceride levels have actually improved slightly (within the 'normal' range), although my HDL:total cholesterol ratio could still be improved, and my LDL ('bad' cholesterol) levels should also be reduced further (this should occur naturally if I loose weight and exercise more...). I should probably start having some tinned tuna in addition to my tin of baked beans for lunch at work.

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

Week 20 38.8 63.6 21.4 118.9 3,371 104.6 6,563

Week 21 33.3 62.9 21.0 105.7 3,056 104.4 6,957

Week 22 20.4 61.6 22.4 123.8 3,390 104.9 8,962

Week 23 32.2 69.6 13.3 106.7 2,840 104.5 6,471

Week 24 32.8 64.5 17.7 116.2 2,808 105.2 7,258

Week 25 20.6 61.3 24.5 63.7 1,894 103.0 8,406

Week 26 43.7 64.4 16.6 113.7 2,475 101.5 10,257

Subscribe to Enough Wealth. Copyright 2006-2017

Tuesday 4 July 2017

Net Worth: Jun 2017

My net worth improved over the past month, due mostly to a large biannual dividend received into our SMSF Vanguard High-growth Fund investment. Overall, my retirement savings balance increased by $41,108 (+4.80%), which more than offset a decrease in the value of my geared stock portfolio, which was down $13,666 (-6.72% due to gearing). The decrease in net value of my geared stock portfolio was partly due to some weakness in the stock markets, but also due to making prepayments for the next 12 months of margin loan interest on most of the loan balance (I only kept a smal proportion of these loan balances as 'variable', so I can pay off some of the loan balances if I have spare cashflow). The valuation of our home also increased slightly last month. DW is still unemployed, so she withdrew some of the money she'd deposited into the joint savings account for monthly loan payments next year (which made the mortgage amount increase slightly in my NW calculations).

Subscribe to Enough Wealth. Copyright 2006-2017

Subscribe to Enough Wealth. Copyright 2006-2017

Monday 26 June 2017

Diet & Exercise update - Week 25

Well, my 'new' (restarted) diet regime got off to a fairly good start last week, mostly due to not being able to eat very solid foods after getting a tooth extracted on Thursday afternoon!. Although I haven't yet restarted doing 5BX daily exercise sessions or weekly squash with the kids, I did reach my daily step-count target of 12,000 steps on four of the days last week. I didn't do much walking on the day I got my tooth extracted, or over the weekend. As I couldn't eat too much anyhow, I took the opportunity to do two days of my mock-'fasting mimicking diet' (FMD) plan on the weekend. While the overall carb, fat and protein ratio is fairly close to that published by Dr Longo, I don't try to mimic the micro-nutrient or other compositional aspects of his commercialized diet regime. As I take a daily multivitamin, calcium and Vitamin D supplement, I'm not too worried about working out the finer details of my diet's nutritional makeup. I also intend to just utilize my version of FMD on two days every weekend, rather than Dr Longo's FMD schedule of five sequential days every month or two.

This week I plan on walking at least 12K steps every day, and to start doing daily 5BX exercise routine again in the evenings. Next weekend I'll be driving up to the lake house with DS2, so he can stay there with my parents during the two week school vacation. DS1 is staying home this vacation to study for his HSC exams (his trial HSC exams start in the third week on next term). As it is a three hour drive up to the lake house, I'll need to make sure I do enough walking on those days.

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

Week 20 38.8 63.6 21.4 118.9 3,371 104.6 6,563

Week 21 33.3 62.9 21.0 105.7 3,056 104.4 6,957

Week 22 20.4 61.6 22.4 123.8 3,390 104.9 8,962

Week 23 32.2 69.6 13.3 106.7 2,840 104.5 6,471

Week 24 32.8 64.5 17.7 116.2 2,808 105.2 7,258

Week 25 20.6 61.3 24.5 63.7 1,894 103.0 8,406

Subscribe to Enough Wealth. Copyright 2006-2017

This week I plan on walking at least 12K steps every day, and to start doing daily 5BX exercise routine again in the evenings. Next weekend I'll be driving up to the lake house with DS2, so he can stay there with my parents during the two week school vacation. DS1 is staying home this vacation to study for his HSC exams (his trial HSC exams start in the third week on next term). As it is a three hour drive up to the lake house, I'll need to make sure I do enough walking on those days.

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

Week 20 38.8 63.6 21.4 118.9 3,371 104.6 6,563

Week 21 33.3 62.9 21.0 105.7 3,056 104.4 6,957

Week 22 20.4 61.6 22.4 123.8 3,390 104.9 8,962

Week 23 32.2 69.6 13.3 106.7 2,840 104.5 6,471

Week 24 32.8 64.5 17.7 116.2 2,808 105.2 7,258

Week 25 20.6 61.3 24.5 63.7 1,894 103.0 8,406

Subscribe to Enough Wealth. Copyright 2006-2017

Friday 23 June 2017

Ouch, That hurt my wallet (and my mouth

Had a 'fun' day off work yesterday - got some fasting blood tests done in the morning (covered by Medicare), in preparation for my visit to the eczema/immunology specialist in two weeks time. And then had an after lunch session with the dentist to get a premolar tooth extracted (it had two previously rounds of expensive root canal therapy by two different dentists, which didn't fix the problem).

I was told the extraction would take about an hour, but I ended up being in the 'chair' for almost two hours. Aside from some small pricks getting the initial local anesthetic injections, the whole proceed was quite painless, although uncomfortably. It involved the tooth extraction, 'grafting', a few stiches, and then an x-ray to check the final result. I'll be going back for a short visit in a couple of weeks to get the few stitches removed. This two hour marathon session cost just under A$1000, but at least there was a lot of time, effort and materials involved. A large proportion of the bill was covered by my employer-funded health plan, so my 'out of pocket' was under A$200.

There was somewhat greater pain involved when the local wore off. I'm on soft/liquid foods only for a couple of days, and taking some pain-killers today. Hopefully it will have 'settled down' by tomorrow morning.

Later in the year I'll need to have some more expensive work done to insert a 'prosthetic' tooth in the gap. Makes me wish I'd done a bit more cleaning and flossing of my teeth during the past forty years!

Subscribe to Enough Wealth. Copyright 2006-2017

I was told the extraction would take about an hour, but I ended up being in the 'chair' for almost two hours. Aside from some small pricks getting the initial local anesthetic injections, the whole proceed was quite painless, although uncomfortably. It involved the tooth extraction, 'grafting', a few stiches, and then an x-ray to check the final result. I'll be going back for a short visit in a couple of weeks to get the few stitches removed. This two hour marathon session cost just under A$1000, but at least there was a lot of time, effort and materials involved. A large proportion of the bill was covered by my employer-funded health plan, so my 'out of pocket' was under A$200.

There was somewhat greater pain involved when the local wore off. I'm on soft/liquid foods only for a couple of days, and taking some pain-killers today. Hopefully it will have 'settled down' by tomorrow morning.

Later in the year I'll need to have some more expensive work done to insert a 'prosthetic' tooth in the gap. Makes me wish I'd done a bit more cleaning and flossing of my teeth during the past forty years!

Subscribe to Enough Wealth. Copyright 2006-2017

Monday 19 June 2017

Diet & Exercise update - 2017 Weeks 7-24

Well, 2017 has so far been a diet disaster ;(

We had a very hot and humid summer, and my eczema got quite bad due to a heat rash, so I've been feeling unwell, lethargic and irritable. I'm not sure if being unwell was the main cause, but I found it impossible to stick to my diet, and I had been buying confectionery whenever I went grocery shopping, and then eating lollies in the evenings as 'comfort food'. The heat rash and eczema also reduced the amount of walking I was doing (at least until the weather cooled down in May), and I haven't been doing my weekly game of squash due to my skin.

Overall, my weight increased from 97kg at the start of the year, up to 105kg last week! Considering I had got my weight down to 89kg this time last year, it is a really bad result.

A recent course of antibiotics and prednisone seems to have finally gotten my skin back under control, and I've been walking a bit more since the weather cooled down in May. I managed to stick to my diet plan last weekend, so I intend to stick fully to my diet starting from.... NOW! Hopefully doing a weekly blog post might also help motivate/embarrass me into sticking to my plan.

I won't bother listing all the weekly stats for 2017, but the overall figures from weeks 1-24 and the past week are below:

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

2017

Weeks 1-24 37.5 64.1 18.3 118.9 3,019 102.1 6,025

Week 24 32.8 64.5 17.7 116.2 2,803 105.2 7,258

Goes to show what a few hundred extra calories every day, and a lack of exercise will achieve ;(

I'll start reporting weekly figures again from now on. Wish me luck.

Subscribe to Enough Wealth. Copyright 2006-2017

We had a very hot and humid summer, and my eczema got quite bad due to a heat rash, so I've been feeling unwell, lethargic and irritable. I'm not sure if being unwell was the main cause, but I found it impossible to stick to my diet, and I had been buying confectionery whenever I went grocery shopping, and then eating lollies in the evenings as 'comfort food'. The heat rash and eczema also reduced the amount of walking I was doing (at least until the weather cooled down in May), and I haven't been doing my weekly game of squash due to my skin.

Overall, my weight increased from 97kg at the start of the year, up to 105kg last week! Considering I had got my weight down to 89kg this time last year, it is a really bad result.

A recent course of antibiotics and prednisone seems to have finally gotten my skin back under control, and I've been walking a bit more since the weather cooled down in May. I managed to stick to my diet plan last weekend, so I intend to stick fully to my diet starting from.... NOW! Hopefully doing a weekly blog post might also help motivate/embarrass me into sticking to my plan.

I won't bother listing all the weekly stats for 2017, but the overall figures from weeks 1-24 and the past week are below:

. Fibre Carbs Fat Protein kCals Avg Wt Steps

g/dy % % g/dy /dy kg /dy

2017

Weeks 1-24 37.5 64.1 18.3 118.9 3,019 102.1 6,025

Week 24 32.8 64.5 17.7 116.2 2,803 105.2 7,258

Goes to show what a few hundred extra calories every day, and a lack of exercise will achieve ;(

I'll start reporting weekly figures again from now on. Wish me luck.

Subscribe to Enough Wealth. Copyright 2006-2017

Making money Bitcoin 'mining' is harder than it looks

Well, for one thing I'm not really 'mining' Bitcoin -- I haven't bought the hardware normally used to 'mine' new Bitcoin (apparently you have to have access to really cheap electricity to make it worthwhile - hence the big mining 'farms' are located close to cheap sources of hydro or geothermal power) and are only running a mining app on my home laptop that works as part of a cloud-based 'pool'. At least it is generating a few thousand Satoshi each day (unfortunatey a Satoshi is only 1/100,000,000th of a Bitcoin!) and every time the modest threshold is reached some Satoshi actually get transferred into my CoPay 'wallet'. So far I've had 22 transfers of around 5000 Satoshi, with my total Bitcoin balance reaching 0.00113797 BTC (worth around A$3.57 at today's rate). And I'm pretty sure the cost of the electricity used leaving my laptop turned on overnight is more than that amount ;(

And my other attempt to 'earn' Bitcoin via an app on my phone was a total rip-off. Having wasted time clicking on ads (which I'm sure earned the app developer some money), the 'payment' of the first 400,000 Satoshi I'd earned never arrived in my Bitcoin wallet. And all attempts to get 'help' were ignored by the developer.

Subscribe to Enough Wealth. Copyright 2006-2017

And my other attempt to 'earn' Bitcoin via an app on my phone was a total rip-off. Having wasted time clicking on ads (which I'm sure earned the app developer some money), the 'payment' of the first 400,000 Satoshi I'd earned never arrived in my Bitcoin wallet. And all attempts to get 'help' were ignored by the developer.

Subscribe to Enough Wealth. Copyright 2006-2017

Thursday 15 June 2017

Electricity costs going through the roof

Electricity has been in the news quite a lot this year in Australia. South Australia had power blackouts during the Summer when an unusual weather pattern produced lots of cloud cover and no wind -- making their high reliance on wind/solar 'renewal' power supplies problematic. Normally they'd have managed using 'surplus' power from neighboring states (Victoria and NSW), but some issues with the instate load-sharing system apparently meant this wasn't possible, so some 'planned outages' were required. A lot of unhappy South Australians, and a lot of media discussion regarding whether the problem was due to over-reliance on 'renewal' power supplies, without adequate base-load supply or a means to store power (Elon Musk got in the act by offering to sell some 'cheap' battery storage to Australia), or whether it was just due to a problem with the interstate transmission system...

Anyhow, aside from supply issues, the cost of electricity to consumers has already been increasing faster than inflation for many years, and some even larger increases will soon bite. A just received an email from my electricity supplier showing my 'old' rates and the 'new' rates that will apply from next month. The head-line 'peak' rate is rising from ~54c per kWh to ~59.2c per kWh (an increase of 9.6%!). However, the reality is even worse, as the 'shoulder' and 'off-peak' rates will be increasing much more - 'shoulder' period electricity is increasing by 24.4% (!!) from ~21.6c per kWh to ~24.4c per kWh, and the 'off-peak' rate (used to heat up our hot water tank at 1-2am) is increasing by an eye-watering 36.5% (!!!!) from ~12c per kWh to ~16.4c per kWh.

Overall, based on last quarter's electricity bill, our mix of off-peak/shoulder/peak electricity use, and the total amount used, our overall bill will be increasing by around 18.8% from next month unless we take some drastic energy-saving measures. We've already time-shifted our normal electricity use as much as possible from peak period to shoulder (by not using the washing machine during the evening 'peak' hours), so now we'll have to look at reducing the amount of power used. Looking at our hour-by-hour energy use (fortunately the data is readily available online these days), it appears that when we were running the pool filter it uses around 0.5 kWh, so I definitely have to only run it for a couple of hours daily rather than non-stop. It was also noticeable that when the family was away during the school holidays, the household 'baseline' electricity use was around 0.25 kWh each hour (probably due to leaving the refrigerator running, a few 'security' lights on, and the various TVs and computers left in 'standby' mode. And the water-bed heater) When the family is at home the 'baseline' power use is around 0.25-0.5 kWh per hour higher, probably due to leaving some lights on during the day, and having more laptops/tablets etc. left plugged in to charge up etc.

I'll have to start actively checking that computers, TVs etc. are turned off rather than left in stand-bye mode during the day, and checking that no lights are left on during the day or when everyone goes to bed. We'll see how much of the hike in electricity prices can be off-set by being more frugal with our electricity usage...

Subscribe to Enough Wealth. Copyright 2006-2017

Anyhow, aside from supply issues, the cost of electricity to consumers has already been increasing faster than inflation for many years, and some even larger increases will soon bite. A just received an email from my electricity supplier showing my 'old' rates and the 'new' rates that will apply from next month. The head-line 'peak' rate is rising from ~54c per kWh to ~59.2c per kWh (an increase of 9.6%!). However, the reality is even worse, as the 'shoulder' and 'off-peak' rates will be increasing much more - 'shoulder' period electricity is increasing by 24.4% (!!) from ~21.6c per kWh to ~24.4c per kWh, and the 'off-peak' rate (used to heat up our hot water tank at 1-2am) is increasing by an eye-watering 36.5% (!!!!) from ~12c per kWh to ~16.4c per kWh.